Intro

Accounting and tax services sit firmly in high-stakes YMYL territory.

They influence:

- Tax liabilities

- Legal compliance

- Business viability

- Personal financial risk

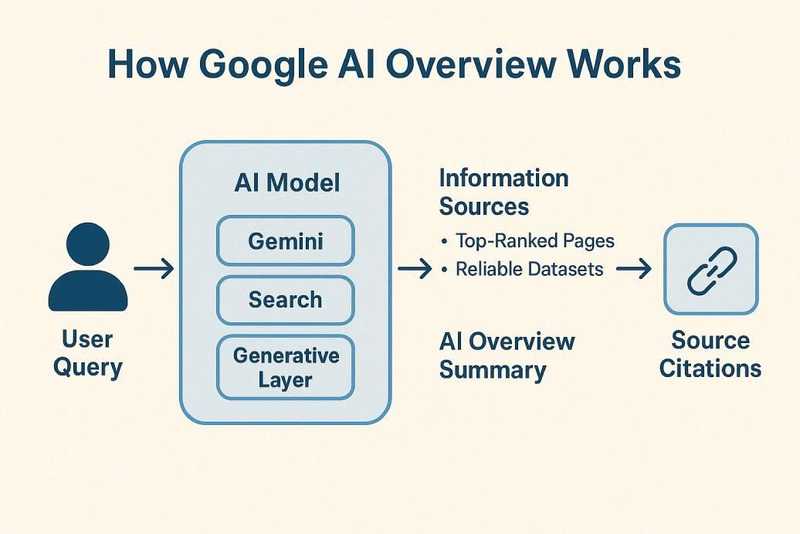

AI Overviews fundamentally change how this expertise is discovered and trusted.

Google is no longer just ranking accountant websites, tax guides, or “best CPA near me” pages. It is summarising tax concepts, compliance obligations, filing risks, and common mistakes directly in the SERP — often before a user ever contacts a professional.

For accounting firms, tax advisors, and bookkeeping services, this is not a visibility tweak. It is a credibility and authority filter.

This article is part of Ranktracker’s AI Overviews series and goes deep into how AI Overviews affect accounting and tax services specifically, how client behaviour changes, how Google evaluates trust in regulated professional services, what content influences AI summaries, and how firms can remain visible and chosen in an AI-first search landscape.

1. Why AI Overviews Matter More for Accounting & Tax Than Most Local Services

Tax and accounting advice can cause irreversible damage when misunderstood.

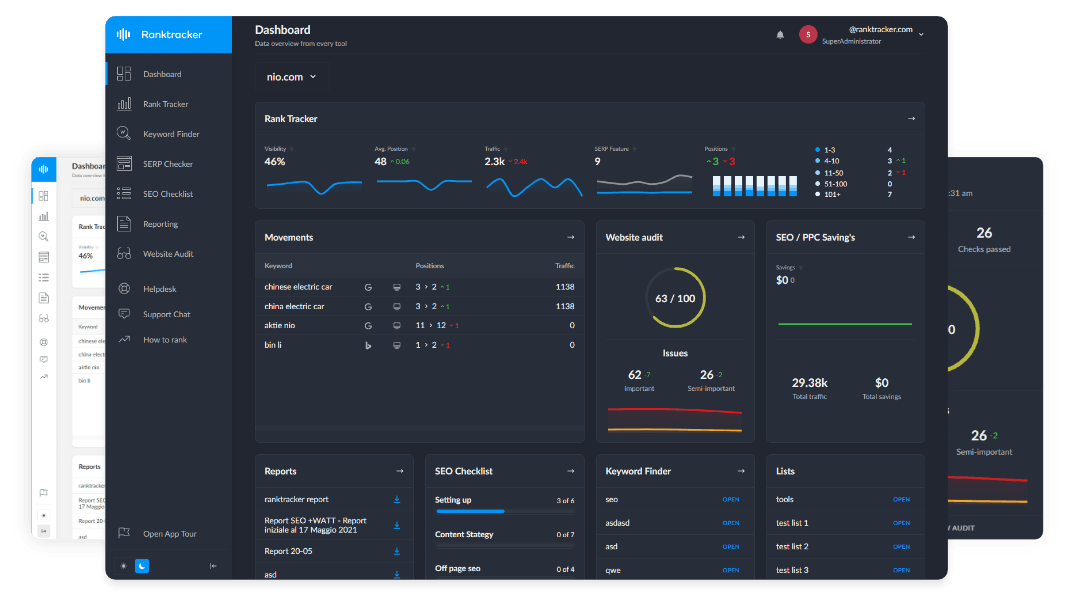

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Google treats this category aggressively because:

- Incorrect guidance leads to penalties and audits

- Laws vary by country and region

- “Generic” advice is often wrong in context

- Consumers routinely misunderstand obligations

AI Overviews are designed to educate cautiously, not replace professionals.

Accounting & Tax Queries Trigger AI Overviews by Default

Common examples include:

- “Do I need an accountant?”

- “What expenses are tax deductible?”

- “Is hiring a CPA worth it?”

- “What happens if I file taxes late?”

- “How does VAT work?”

These searches used to drive traffic to:

- Blog posts

- Service explainers

- Lead-generation pages

Now, Google often answers with a careful, conditional AI summary.

If your firm is not trusted enough, it may never be referenced — even if you rank.

AI Overviews Do Not Give Advice — They Define Risk

Accounting and tax firms are not evaluated on:

- Marketing claims

- Free advice positioning

- “Save more tax” language

They are evaluated on:

- Accuracy

- Neutrality

- Jurisdiction awareness

- Professional restraint

2. How AI Overviews Reshape the Accounting & Tax Client Journey

AI Overviews compress education while elevating caution.

Awareness → Compliance Framing

AI Overviews define:

- That tax rules vary by jurisdiction

- That mistakes have consequences

- That professional advice may be required

- That generic advice has limits

This happens before service offerings are even considered.

Comparison → Professional Filtering

Instead of asking:

- “Which accountant is cheapest?”

Clients increasingly ask:

- “Is this firm qualified?”

- “Do they understand my situation?”

- “Are they compliant and regulated?”

AI Overviews strongly influence this perception.

Conversion → Confirmation, Not Persuasion

When users do click:

- They expect disclaimers

- They expect nuance

- They expect alignment with Google’s explanation

Anything that sounds more confident than the AI summary can reduce trust.

3. The Accounting SEO Attribution Illusion

Accounting firms may notice:

- Lower blog traffic

- Fewer low-quality enquiries

- Better-qualified leads

- Shorter consultation cycles

This feels counterintuitive.

Your content may:

- Shape AI summaries

- Pre-educate prospects

- Filter out risky or irrelevant cases

But analytics show:

“Organic traffic is declining”

In reality:

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

SEO is influencing who is safe and serious enough to enquire.

AI Overviews create pre-qualified clients.

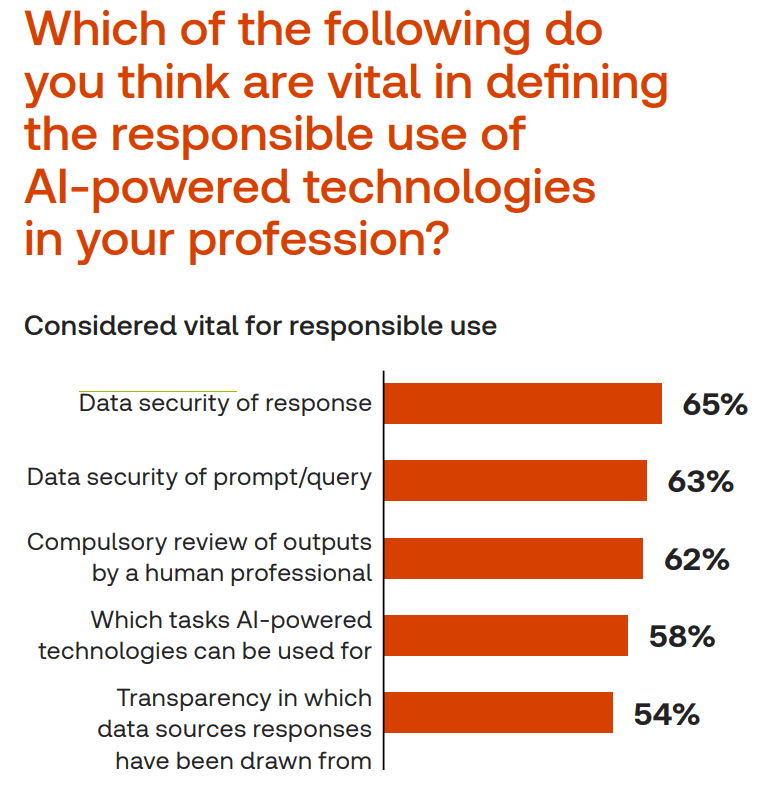

4. How Google Chooses Sources for Accounting & Tax AI Overviews

Google applies professional-services trust heuristics.

4.1 Credentials and Expertise Are Mandatory

AI Overviews favour sources that:

- Clearly state qualifications (CPA, ACCA, Chartered Accountant, etc.)

- Identify authors or firm oversight

- Demonstrate experience

- Avoid anonymous advice

Generic blogs are excluded.

4.2 Jurisdiction Awareness Is Critical

AI penalises content that:

- Ignores regional tax law differences

- Presents universal rules

- Omits legal context

Localised, scoped explanations win.

4.3 Neutral Education Beats Tax-Saving Claims

AI distrusts:

- Aggressive “reduce your tax” language

- Guaranteed savings

- Oversimplified deductions

Risk-aware education signals trust.

4.4 Entity-Level Trust Overrides Page SEO

Accounting firms are evaluated as professional entities, not content publishers.

Signals include:

- Firm reputation

- Mentions across authoritative sites

- Consistent explanations across the site

- Absence of misleading advice

One incorrect article can harm domain-wide trust.

5. The Strategic Shift for Accounting & Tax SEO

Old Accounting SEO

- Rank service pages

- Publish tax tips blogs

- Capture leads via content

- Scale generic advice

AI-First Accounting SEO

- Educate cautiously

- Lead with compliance context

- Emphasise professional scope

- Become the source Google feels safe referencing

If Google doesn’t feel safe explaining tax using your content, it won’t use it.

6. Content Types That Influence AI Overviews for Accounting & Tax Services

6.1 Foundational Tax & Accounting Education

Examples:

- “How income tax works”

- “Difference between bookkeeping and accounting”

- “What accountants actually do”

These anchor AI explanations.

6.2 Risk & Compliance Content

AI Overviews pull from content explaining:

- Penalties

- Filing errors

- Audit triggers

- Record-keeping requirements

Risk clarity increases trust.

6.3 Jurisdiction-Specific Guides

AI trusts content that clearly scopes:

- Country-specific rules

- VAT vs sales tax

- Local compliance obligations

Specificity beats scale.

6.4 “When You Need a Professional” Content

Explaining:

- DIY limits

- Complex scenarios

- Business vs personal tax boundaries

Aligns with Google’s harm-reduction goals.

7. How to Structure Accounting Content for AI Overviews

Lead With Scope and Limitations

Every key page should state:

- Jurisdiction covered

- What the content explains

- What it does not replace

- When professional advice is required

AI extracts early content aggressively.

Use Conservative, Conditional Language

Words like:

- “Depends on circumstances”

- “Subject to local law”

- “May require professional advice”

Increase AI trust significantly.

Centralise Definitions and Standards

Winning firms:

- Use consistent terminology

- Avoid contradictory guidance

- Align blogs, FAQs, and service pages

AI punishes inconsistency heavily.

8. Measuring Accounting SEO Success in an AI Overview World

Traffic is no longer the main KPI.

Accounting firms should track:

- AI Overview inclusion

- Lead quality

- Consultation conversion rates

- Client understanding at first contact

- Reduced compliance risk cases

SEO becomes client education infrastructure, not traffic acquisition.

9. Why AI Overview Tracking Is Critical for Accounting & Tax Firms

Without AI Overview tracking, firms lose visibility into how Google interprets their authority.

You won’t know:

- Which explanations Google uses

- Whether competitors are seen as more credible

- When trust erodes

- Where content needs tightening

This is where Ranktracker becomes strategically important.

Ranktracker enables accounting and tax firms to:

- Track AI Overviews per tax and accounting keyword

- Monitor desktop and mobile AI summaries

- Compare AI visibility with Top 100 rankings

- Detect credibility loss before lead quality drops

You cannot manage modern professional-services SEO without AI-layer visibility.

10. Conclusion: AI Overviews Decide Which Accounting Advice Is “Safe Enough” to Be Seen

AI Overviews do not replace accountants. They decide which professionals sound credible.

In an AI-first accounting SERP:

- Accuracy beats marketing

- Caution beats confidence

- Consistency beats volume

- Trust beats rankings

Accounting and tax services that adapt will:

- Attract better-qualified clients

- Reduce compliance risk

- Shorten sales cycles

- Build durable professional authority

The accounting SEO question has changed.

It is no longer:

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

“How do we rank accounting keywords?”

It is now:

“Does Google trust us enough to explain accounting and tax compliance using our words?”

Those who earn that trust shape how financial responsibility is understood.