Intro

Banking and lending websites operate under the strictest trust expectations on the web.

They influence:

- Debt decisions

- Creditworthiness

- Long-term financial health

- Legal and regulatory outcomes

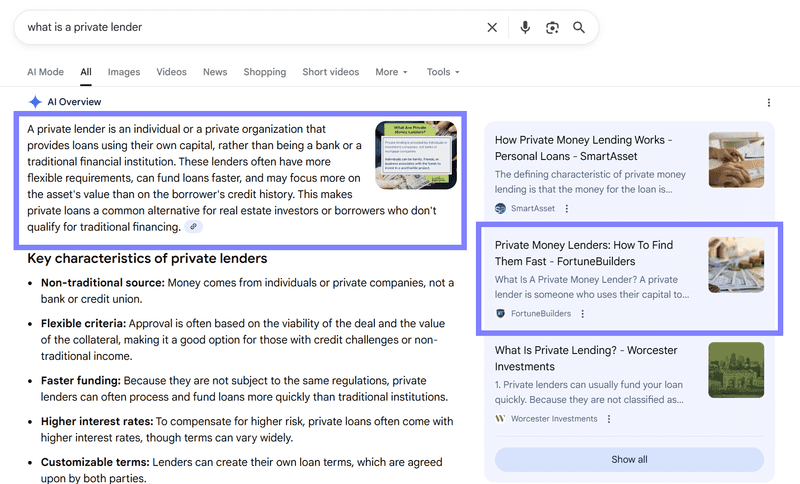

AI Overviews fundamentally reshape how this information is surfaced.

Google is no longer just ranking bank pages, loan calculators, or comparison content. It is summarising how borrowing works, what risks exist, who loans are suitable for, and what consumers should be cautious about — directly in the SERP.

For banks, lenders, and credit providers, this is not a traffic optimisation challenge. It is a credibility and compliance gate.

This article is part of Ranktracker’s AI Overviews series and goes deep into how AI Overviews affect banking and lending websites specifically, how borrower behaviour changes, how Google evaluates trust in regulated finance, what content influences AI summaries, and how financial institutions can remain visible and authoritative in an AI-first search landscape.

1. Why AI Overviews Matter More for Banking & Lending Than Most Finance Verticals

Borrowing money is a high-impact, high-risk decision.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Google treats loan-related content as core YMYL because:

- Financial harm is irreversible

- Misleading advice causes long-term damage

- Regulation varies by country

- Consumers often misunderstand risk

AI Overviews are designed to reduce harm, not increase conversion rates.

Lending Queries Trigger AI Overviews by Default

Common examples include:

- “Is taking a personal loan a good idea?”

- “How do bank loans work?”

- “Is [bank/lender] safe?”

- “What credit score do I need for a loan?”

- “Fixed vs variable interest rate”

These queries used to drive traffic to:

- Loan landing pages

- Rate comparison tools

- Affiliate-driven content

Now, Google often answers directly with a cautious, neutral AI summary.

If your site does not meet trust requirements, it is excluded — even if it ranks organically.

AI Overviews Do Not Sell Loans — They Explain Risk

Banking and lending brands are not evaluated on:

- Conversion-focused copy

- Promotional offers

- Low-rate claims

They are evaluated on:

- Transparency

- Consumer protection

- Regulatory clarity

- Neutral financial education

2. How AI Overviews Reshape the Banking & Lending Customer Journey

AI Overviews intentionally slow borrowing decisions.

Awareness → Risk & Responsibility Framing

AI Overviews define:

- That loans must be repaid with interest

- That borrowing affects credit scores

- That affordability matters more than approval

- That alternatives may exist

This happens before loan products are even considered.

Comparison → Safety Filtering

Instead of asking:

- “Which lender is cheapest?”

Users increasingly ask:

- “Is this lender legitimate?”

- “What protections exist?”

- “What happens if I can’t repay?”

AI Overviews strongly influence these judgments.

Conversion → Confirmation, Not Persuasion

When users do click:

- They expect disclosures

- They expect consistency with Google’s explanation

- They expect responsible messaging

Any mismatch reduces trust immediately.

3. The Banking SEO Attribution Illusion

Banks and lenders may notice:

- Lower organic traffic

- Fewer impulsive applications

- Higher application quality

- Reduced default-risk enquiries

This feels counterintuitive.

Your content may:

- Influence AI summaries

- Pre-educate borrowers

- Filter high-risk applicants

But analytics say:

“Organic traffic is declining”

In reality:

SEO is shaping who feels safe enough to borrow.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

AI Overviews create risk-qualified borrowers.

4. How Google Chooses Sources for Banking & Lending AI Overviews

Google applies maximum trust and compliance heuristics.

4.1 Regulatory Transparency Is Mandatory

AI Overviews favour sources that:

- Clearly state licensing and regulation

- Explain jurisdictional limitations

- Mention consumer protections

- Avoid ambiguous claims

Unclear compliance language is disqualifying.

4.2 Neutral Education Beats Product Promotion

AI penalises:

- “Best loan” framing

- Overemphasis on approval speed

- Emotional borrowing language

- Hidden cost minimisation

Educational neutrality wins.

4.3 Entity-Level Trust Overrides Page SEO

Banking websites are evaluated as financial institutions, not publishers.

Signals include:

- Brand reputation

- Regulatory references

- Press and authority citations

- Long-term messaging consistency

One misleading page can affect the entire domain.

4.4 Stability Over Time Matters

AI Overviews favour lenders that:

- Maintain consistent definitions

- Update rates transparently

- Avoid marketing-driven narrative shifts

Stability signals responsibility.

5. The Strategic Shift for Banking & Lending SEO

Old Banking SEO

- Rank loan keywords

- Push calculators and offers

- Optimise for lead volume

- Scale landing pages

AI-First Banking SEO

- Build institutional trust

- Explain borrowing responsibly

- Lead with affordability and risk

- Become the “safe explanation” Google relies on

If Google doesn’t feel safe explaining loans using your content, it won’t use it.

6. Content Types That Influence AI Overviews for Banking & Lending

6.1 Foundational Borrowing Education

Examples:

- “How loans work”

- “What interest really costs”

- “How repayment schedules affect debt”

These anchor AI explanations.

6.2 Risk & Affordability Content

AI Overviews pull from content that explains:

- Over-borrowing risks

- Missed payment consequences

- Long-term cost of debt

- Credit score impact

Risk transparency increases trust.

6.3 Loan Type Comparisons (Neutral)

AI trusts content explaining:

- Personal loans vs credit cards

- Secured vs unsecured loans

- Fixed vs variable interest rates

Neutral framing beats product-led pages.

6.4 Consumer Protection & Rights Pages

Explaining:

- Cooling-off periods

- Complaint processes

- Early repayment rules

- What happens in financial difficulty

Aligns with Google’s harm-reduction goals.

7. How to Structure Banking Content for AI Overviews

Lead With Context and Responsibility

Loan pages should open with:

- What the product does

- Who it’s suitable for

- Who it may not suit

- Key risks involved

AI extracts early content aggressively.

Use Conservative, Conditional Language

Words like:

- “May affect your credit score”

- “Subject to affordability checks”

- “Depends on individual circumstances”

Increase AI trust significantly.

Centralise Definitions and Assumptions

Winning banking sites:

- Use consistent terminology

- Avoid internal contradictions

- Maintain one interpretation of lending rules

AI punishes inconsistency harshly.

8. Measuring Banking SEO Success in an AI Overview World

Traffic volume is no longer the primary KPI.

Banks and lenders should track:

- Keywords triggering AI Overviews

- Brand presence in AI summaries

- Application quality

- Default-risk indicators

- Customer understanding at onboarding

SEO becomes borrower education infrastructure, not traffic generation.

9. Why AI Overview Tracking Is Critical for Banking & Lending Websites

Without AI Overview tracking, financial institutions lose visibility into how Google judges their trustworthiness.

You won’t know:

- If your bank is included in AI explanations

- Which competitors are deemed safer

- When messaging weakens trust

- Where compliance explanations are insufficient

This is where Ranktracker becomes essential.

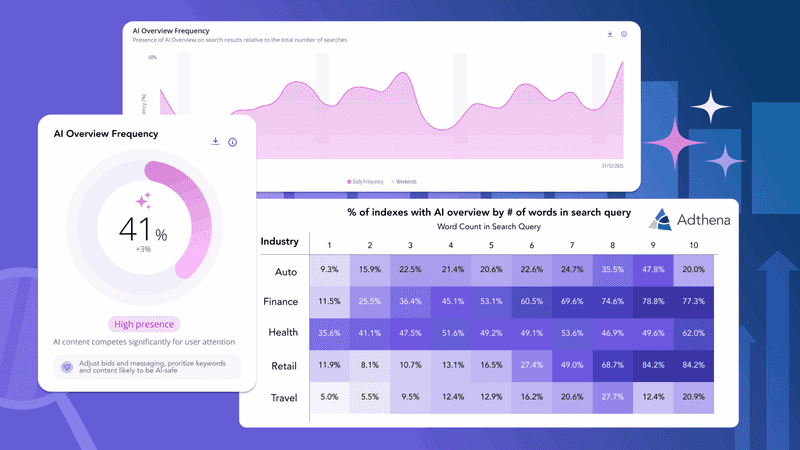

Ranktracker enables banking and lending teams to:

- Track AI Overviews per loan-related keyword

- Monitor desktop and mobile AI summaries

- Compare AI visibility with Top 100 rankings

- Detect trust erosion before applications decline

You cannot manage modern banking SEO without AI-layer observability.

10. Conclusion: AI Overviews Decide Which Banks and Lenders Are “Safe Enough” to Explain

AI Overviews do not reward aggressive lending. They reward responsibility.

In an AI-first banking SERP:

- Safety beats speed

- Education beats persuasion

- Consistency beats scale

- Trust beats rankings

Banking and lending websites that adapt will:

- Maintain long-term visibility

- Attract better-fit borrowers

- Reduce regulatory and reputational risk

- Influence borrowing decisions responsibly

The banking SEO question has changed.

It is no longer:

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

“How do we rank loan keywords?”

It is now:

“Does Google trust us enough to explain borrowing using our words?”

Those who earn that trust shape how borrowing is understood at scale.