Intro

Mortgage and loan websites sit at the most financially sensitive edge of search.

They influence:

- Long-term debt commitments

- Household affordability and risk

- Credit outcomes and defaults

- Life decisions tied to housing, education, and business

Because of this, Google treats mortgage and lending content as strict YMYL.

AI Overviews now appear before borrowers compare rates or click calculators.

Google is no longer just ranking mortgage pages, APR tables, or loan calculators. It is summarising eligibility factors, explaining rate variability, highlighting risks, and clarifying when professional advice is needed — directly in the SERP.

For mortgage and loan sites, this is not a traffic issue. It is a trust, precision, and expectation-alignment issue.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

This article is part of Ranktracker’s AI Overviews series and explains how AI Overviews affect mortgage & loan websites, how borrower behaviour changes, how Google evaluates lending credibility, what content still shapes AI summaries, and how lenders, brokers, and comparison sites can win when Google pre-frames borrowing decisions before the click.

1. Why AI Overviews Hit Mortgage & Loan Search So Hard

Borrowing queries are:

- High-risk and long-term

- Highly personalised

- Rate-sensitive and volatile

- Easy to mislead with averages

This makes them ideal for AI Overviews — and unforgiving for vague content.

Mortgage & Loan Queries That Trigger AI Overviews

Examples include:

- “What mortgage can I afford?”

- “Best mortgage rates today”

- “Fixed vs variable mortgage”

- “Personal loan eligibility”

- “Is refinancing worth it?”

Google now responds with:

- Affordability context

- Rate variability explanations

- Credit score sensitivity

- Risk warnings and caveats

If your site relies on headline rates without context, AI Overviews neutralise it instantly.

AI Overviews Replace Rate-First Lending SEO

Historically:

- Lenders led with teaser rates

- Comparison sites ranked tables

- Calculators drove clicks

AI Overviews now:

- Explain why rates differ

- De-emphasise “best rate” claims

- Warn about affordability risk

Mortgage and loan sites no longer compete on who shows the lowest number. They compete on who explains borrowing reality most responsibly.

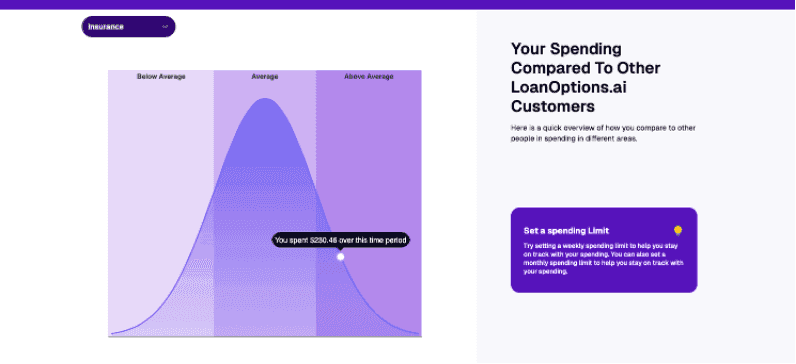

2. How AI Overviews Change Borrower Behaviour

AI Overviews reshape when and why borrowers engage.

Awareness → Affordability Reality Check

Before clicking, users now:

- Learn that rates depend on profile

- See risk of over-borrowing

- Understand trade-offs

This filters out unqualified or unrealistic searches.

Consideration → Fit Over Promotion

When users do click, they want to know:

- “Does this apply to my credit profile?”

- “Are these numbers realistic?”

- “What are the downsides?”

Generic rate pages bounce quickly.

Conversion → Confidence & Transparency

Borrowers convert when:

- Assumptions are clear

- Risks are acknowledged

- Advice feels conservative, not salesy

Aggressive “lock now” messaging reduces trust.

3. The Lending Traffic Illusion

Mortgage and loan sites often see:

- Lower organic traffic

- Fewer calculator starts

- Higher application quality

- Better approval rates

This can feel like decline.

In reality:

AI Overviews are filtering curiosity, not credit demand.

The shift is from rate shopping to risk-aware borrowing.

4. How Google Evaluates Mortgage & Loan Sites for AI Overviews

Google applies financial safety heuristics.

4.1 Accuracy & Assumptions Beat Marketing

AI Overviews favour sites that:

- State assumptions clearly

- Avoid absolute claims

- Explain variability

Teaser rates without context are downgraded.

4.2 Borrower Fit & Eligibility Transparency

AI distrusts content that:

- Ignores credit score impact

- Hides income or deposit requirements

- Claims universal approval

Eligibility clarity builds trust.

4.3 Entity-Level Trust Overrides Page SEO

Mortgage and loan sites are evaluated as financial risk interpreters, not publishers.

Signals include:

- Consistent disclaimers

- Conservative language

- Alignment across calculators, content, and landing pages

One misleading promise can weaken site-wide trust.

5. The Strategic Shift for Mortgage & Loan SEO

Old Lending SEO

- Rank “best rates” keywords

- Publish calculator pages

- Drive application volume

- Monetise leads

AI-First Lending SEO

- Educate before converting

- Frame affordability honestly

- Explain risk and variability

- Monetise qualified intent

If Google doesn’t trust your borrowing framing, it will satisfy the query without sending traffic.

6. Mortgage & Loan Content That Influences AI Overviews

6.1 “How Much Can I Afford?” Content

AI Overviews rely heavily on pages that:

- Explain income-to-debt ratios

- Include buffers and stress tests

- Avoid optimistic assumptions

This shapes SERP guidance directly.

6.2 Fixed vs Variable & Risk Content

AI values content explaining:

- Rate volatility scenarios

- Break fees and penalties

- Long-term cost differences

Nuance beats calculators alone.

6.3 Eligibility & Credit Sensitivity Explainers

AI prefers content that:

- Explains credit score impact

- Clarifies approval criteria

- Avoids universal claims

Precision increases visibility.

6.4 Post-Approval Reality Content

AI cannot infer:

- Repayment stress under rate rises

- Refinance friction

- Fees beyond interest

Sites that explain this honestly gain authority.

7. How Mortgage & Loan Sites Should Structure Pages for AI Overviews

Lead With Assumptions & Risk

Key pages should open with:

- What the numbers assume

- Who qualifies

- What can change

AI extracts early content aggressively.

Avoid “Best Rate” Absolutes

Winning sites:

- Use ranges, not single rates

- Explain why offers differ

- Update timestamps clearly

AI penalises certainty without context.

Standardise Financial Language

Authority lending sites:

- Align calculators, blogs, and product pages

- Use consistent definitions

- Avoid contradictory affordability claims

Consistency compounds AI trust.

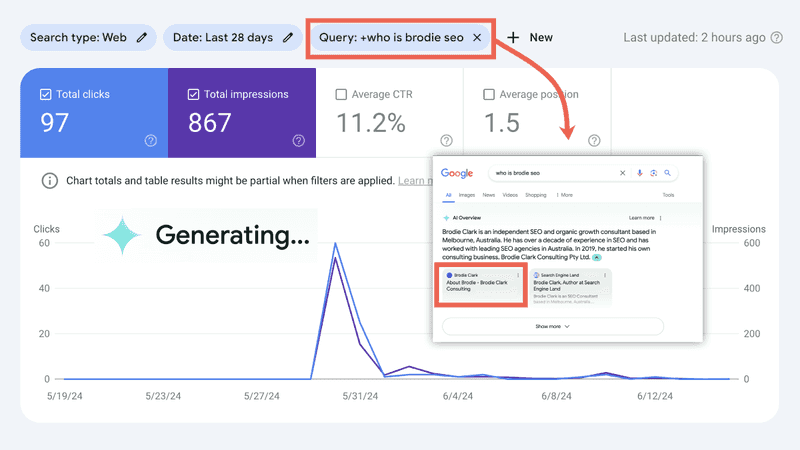

8. Measuring Mortgage & Loan SEO Success in an AI Overview World

Traffic alone is no longer the KPI.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Mortgage and loan sites should track:

- AI Overview inclusion

- Brand mentions in summaries

- Application approval rates

- Borrower quality metrics

- Desktop vs mobile AI visibility

SEO becomes risk-aligned conversion optimisation, not traffic growth.

9. Why AI Overview Tracking Is Critical for Mortgage & Loan Sites

Without AI Overview tracking, lenders and comparison sites cannot see:

- How Google frames borrowing risk

- Whether assumptions align with SERPs

- Which competitors define narratives

- When trust erosion begins pre-application

This is where Ranktracker becomes strategically essential.

Ranktracker enables mortgage and loan sites to:

- Track AI Overviews for lending and rate queries

- Monitor desktop and mobile summaries

- Compare AI visibility with Top 100 rankings

- Detect risk-framing and trust gaps early

You cannot manage lending SEO responsibly without AI-layer visibility.

10. Conclusion: AI Overviews Reward Mortgage & Loan Sites That Reduce Borrower Risk, Not Just Quote Rates

AI Overviews do not harm mortgage and loan websites. They harm misleading, rate-first borrowing content.

In an AI-first lending SERP:

- Accuracy beats promotion

- Risk framing beats optimism

- Transparency beats urgency

- Trust beats traffic

Mortgage and loan sites that adapt will:

- Attract better-qualified borrowers

- Improve approval and retention rates

- Reduce complaints and defaults

- Build durable financial authority

The lending SEO question has changed.

It is no longer:

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

“How do we rank rate pages?”

It is now:

“Does Google trust us to explain borrowing without increasing financial harm?”

Sites that earn that trust don’t lose visibility — they become the financial interpretation layer AI relies on before anyone commits to debt.