Intro

In fintech, regulatory licences have become as valuable as technology. Whether it’s an MSB (Money Services Business), EMI (Electronic Money Institution), or PI (Payment Institution) licence, these authorizations act as gateways to regulated markets across North America, the EU, and the UK.

By 2025, new regulations like MiCA in the EU, the FCA’s expanded crypto regime in the UK, and evolving North American frameworks are raising the bar for market entry.

Startups and investors have two options:

- Apply for a new licence — a process that can take 12–24 months and requires significant legal, operational, and compliance investment.

- Acquire a ready-made licensed entity — through trusted marketplaces, significantly reducing time-to-market and regulatory friction.

This is where financial licence for sale opportunities come in — offering a strategic shortcut for companies aiming to launch quickly in regulated jurisdictions.

2. The Traditional Licensing Route: Slow and Expensive

Applying for a new financial licence typically involves:

- Submitting extensive documentation to regulators

- Building full compliance frameworks before launch

- Undergoing AML/CTF audits and operational checks

- Waiting months (or years) for approval

- Hiring dedicated legal and compliance teams early

While this approach provides control, it often delays market entry and drains resources — a major drawback for startups needing agility.

For investors and fintech companies looking to scale fast across multiple regions, the traditional route often isn’t compatible with their timelines or funding cycles.

3. Why Acquiring a Ready-Made Licence Makes Strategic Sense

Purchasing an existing licensed entity offers several competitive advantages:

- Speed — Launch within weeks, not years, by acquiring a company with an active licence.

- Market Reach — Gain instant access to target jurisdictions with regulatory approval in place.

- Cost Efficiency — Avoid lengthy application costs and build on an existing compliance foundation.

- Strategic Flexibility — Choose a licence type and jurisdiction aligned with your product roadmap.

- Investor Confidence — Having a licence signals regulatory maturity to partners and investors.

This model has gained significant traction in Europe, Canada, and the UK, where demand for regulated fintech solutions is rising.

4. Marketplaces Are Reshaping Licence Acquisition

Previously, buying a financial licence was an opaque process handled through brokers, lawyers, or private networks. Deals were slow, fragmented, and risky.

Today, marketplaces like Finhost are transforming this process by bringing structure, transparency, and due diligence into the equation. Acting as a trusted intermediary, Finhost:

- Aggregates verified, ready-made licensed entities across multiple jurisdictions

- Provides structured listings with clear scope, pricing, and regulatory details

- Conducts due diligence on company status, compliance history, and ownership

- Facilitates secure transactions with legal support and escrow mechanisms

This marketplace model makes acquiring a financial licence for sale far more predictable and accessible — especially for fintech startups without in-house regulatory teams.

5. Compliance Expertise: The Layer That Makes It Work

Acquiring a licence is just the first step. Maintaining compliance under evolving frameworks like MiCA, FCA regulations, and DORA (in the EU) requires specialized operational expertise.

To address this, Finhost offers Compliance as a Service — a managed compliance solution designed to:

- Keep policies and AML/CTF frameworks fully up to date

- Manage reporting obligations to regulators

- Monitor transactions and risks in real time

- Support interactions with banking and regulatory partners

This service acts as a compliance backbone, allowing startups to focus on growth and innovation, while Finhost’s team handles the regulatory side. It’s particularly powerful when combined with a newly acquired licence, ensuring a seamless transition from acquisition to operation.

6. Ideal Use Cases for Licence Acquisition

Acquiring a financial licence is especially strategic in these scenarios:

- Crypto platforms adding fiat payment rails through regulated entities

- Payment startups entering new jurisdictions rapidly

- Institutional fintech products (e.g., custody, FX, brokerage) needing legal clearance

- Cross-border remittance platforms expanding globally

- Investors looking to acquire and rebrand regulated shells for new ventures

In each of these cases, marketplaces simplify discovery and negotiation, while compliance services ensure sustainable growth post-acquisition.

7. Outlook: Licensing Marketplaces as Core Infrastructure

The global regulatory landscape is converging toward higher standards and transparency. Marketplaces for financial licences are becoming infrastructure layers — much like cloud platforms did for computing.

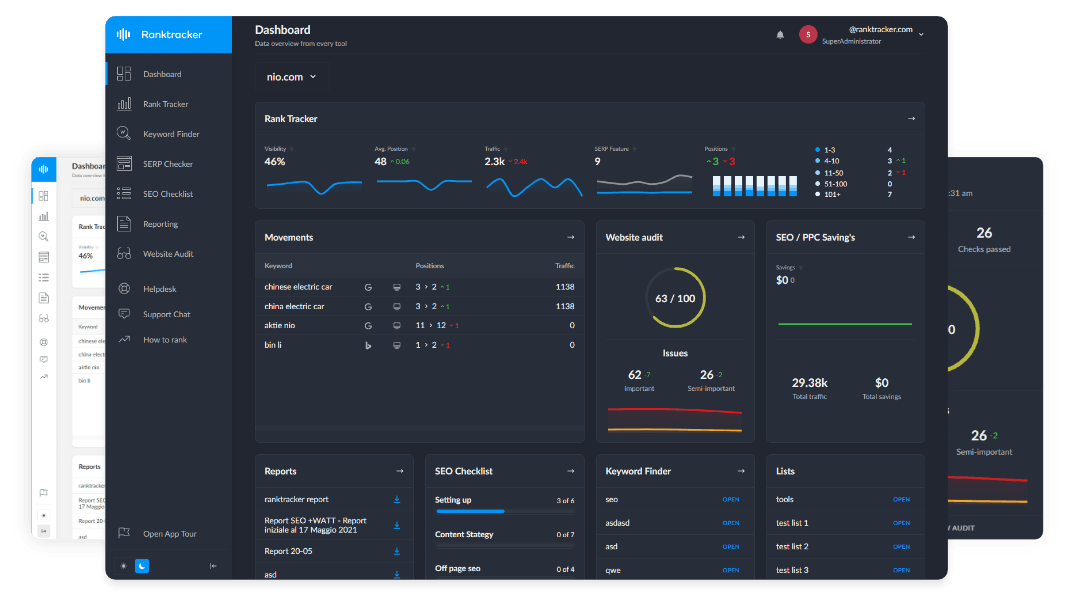

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

In 2025 and beyond, fintech companies will increasingly:

- Acquire licences through structured platforms rather than brokers

- Combine regulatory assets with managed compliance services

- Build modular, multi-jurisdictional architectures faster than incumbents

Finhost is at the forefront of this shift — combining a trusted marketplace with end-to-end compliance solutions to accelerate global fintech expansion.

Entering regulated markets no longer needs to be a multi-year, resource-heavy journey. By leveraging financial licence for sale opportunities through trusted marketplaces like Finhost — and pairing them with Compliance as a Service — fintech companies can launch faster, scale smarter, and stay compliant in a rapidly evolving regulatory environment.

In 2025, this strategic combination isn’t just an alternative — it’s becoming the new standard for global fintech expansion.