Intro

Salary-based searches like 40k after tax, 50k after tax, or 60k after tax have surged in recent years. That’s not because people suddenly care more about tax codes, but because headline salaries no longer tell the full story.

People don’t live on gross pay. They live on what hits their bank account.

This guide breaks down what these common UK salaries look like after tax, what kind of lifestyle they realistically support, and why “after tax” salary searches are some of the highest-intent queries in SEO.

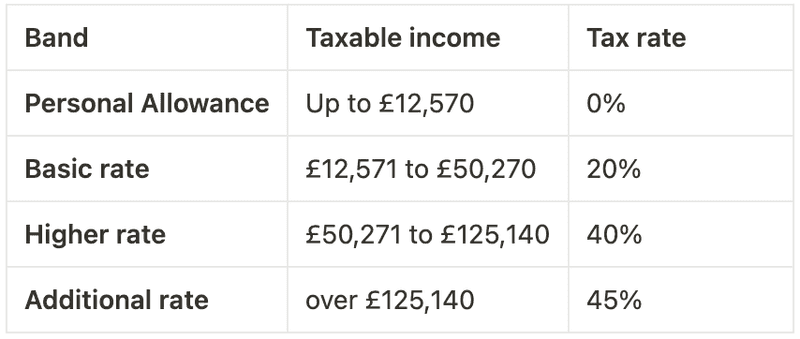

What “After Tax” Actually Means in the UK

When someone searches X salary after tax, they are almost always referring to take-home pay from a gross salary.

All examples below assume:

- Standard UK personal allowance

- PAYE employment

- No student loan repayments

- No additional pension contributions

Tax and National Insurance are calculated and collected by HM Revenue & Customs, and figures can vary slightly by tax year, but these ranges are realistic for most employees.

40k After Tax: What £40,000 Take-Home Pay Looks Like

A £40,000 salary is often seen as a major milestone, especially early or mid-career.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Estimated take-home pay

- Annual: ~£30,500–£31,500

- Monthly: ~£2,550–£2,630

At this level:

- You’re above the UK median salary

- Rent and living costs are manageable in most regions

- Savings are possible, but budgeting still matters

In higher-cost cities, £40k after tax often supports a stable but modest lifestyle. In lower-cost areas, it can stretch much further.

Searches for 40k after tax often come from people moving from entry-level roles into more established positions and reassessing affordability.

45k After Tax: The Comfortable Middle Ground

£45,000 is where many people begin to feel financially “settled.”

Estimated take-home pay

- Annual: ~£34,000–£35,000

- Monthly: ~£2,850–£2,950

At this level:

- Day-to-day expenses feel less restrictive

- Saving becomes more consistent

- Lifestyle flexibility increases

This salary sits in a sweet spot where people feel the impact of tax clearly, but still see noticeable income growth compared to £40k.

That’s why 45k after tax is one of the most searched salary queries in the UK.

50k After Tax: The Psychological Threshold

£50,000 is a mental benchmark for many professionals, but tax plays a big role in how it feels.

Estimated take-home pay

- Annual: ~£37,000–£38,000

- Monthly: ~£3,100–£3,200

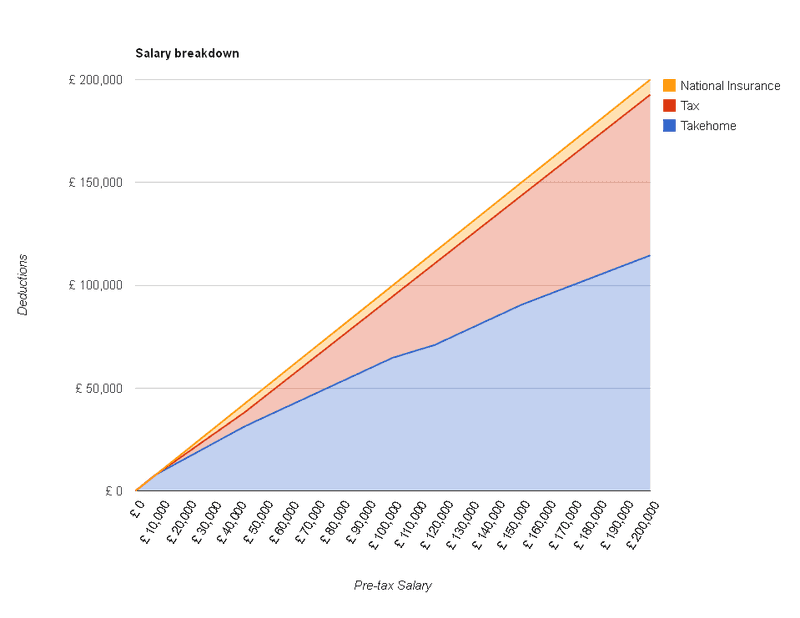

Despite the headline jump, take-home pay does not increase proportionally.

At this level:

- Income tax and NI become more noticeable

- Net pay grows, but not dramatically

- Lifestyle improvements are incremental, not explosive

Searches for 50k after tax often come from people negotiating promotions or offers and wanting to understand whether the jump is “worth it” in real terms.

60k After Tax: When Marginal Tax Really Kicks In

A £60,000 salary sounds high, but tax changes the perception significantly.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Estimated take-home pay

- Annual: ~£42,000–£43,000

- Monthly: ~£3,500–£3,600

At this level:

- A much larger share of income is taxed

- Net pay increases more slowly than gross pay

- Financial comfort improves, but expectations rise too

This is where people often realise that earning more does not always feel like earning much more.

That realisation drives a lot of 60k after tax searches, especially among senior professionals comparing roles.

Why These Salary Searches Matter for SEO

From an SEO perspective, salary-after-tax keywords are powerful because they combine:

- Informational intent

- Decision-making behaviour

- High engagement

- Strong scroll depth

Users searching these terms are not browsing casually. They are:

- Evaluating job offers

- Planning relocations

- Comparing lifestyles

- Budgeting for real decisions

This makes salary clusters ideal for topical authority building, especially when explanations are clear, realistic, and assumption-driven.

For platforms like Ranktracker, this kind of content demonstrates how intent-matching and clarity outperform shallow, calculator-only pages.

Why “After Tax” Queries Are Growing

Even with AI summaries and instant answers, these searches keep increasing because users want more than a number.

They want:

- Context

- Realistic ranges

- Confirmation that assumptions match their situation

- Human explanation, not formulas

That’s why well-written salary content continues to perform strongly in modern search.

Final Takeaway: Comparing 40k, 45k, 50k, and 60k After Tax

Each salary level represents a different financial experience:

- £40k offers stability and careful budgeting

- £45k brings comfort and flexibility

- £50k feels like a milestone but grows net income modestly

- £60k increases comfort but highlights tax efficiency questions

The reason people search after tax is simple: gross salaries don’t pay the bills. Take-home pay does.