Intro

What if we told you that only one out of 26 dissatisfied clients articulates complaints? The other 25 tend to leave you without saying a word.

If you aim at customer-driven financial services, you must learn the cause of their discontent, polish your services, and retain customers.

This is only one of the cases when customer feedback can become a breakthrough point for starting an effective dialogue. Most financial businesses exploit its potential to build customer-centricity in finance. As many as four in five financial organizations gather online feedback from clients.

Would you also like to change your finance game with the power of feedback?

Follow this comprehensive financial customer feedback guide with all the whats, whys, hows, whens, and wheres.

What Are the Types of Customer Feedback in the Financial Industry?

Customer feedback in finance is information clients share about their customer experience with a financial company.

Jim Pendergast, Senior Vice President at altLINE Sobanco, states, “To take a client-oriented approach in the finance sector, you should pay attention to three basic types of feedback. You can monitor customers’ opinions about your financial brand overall, your representative/agent, and your products or services.”

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Get a more complete picture of those through examples.

Feedback about a financial company

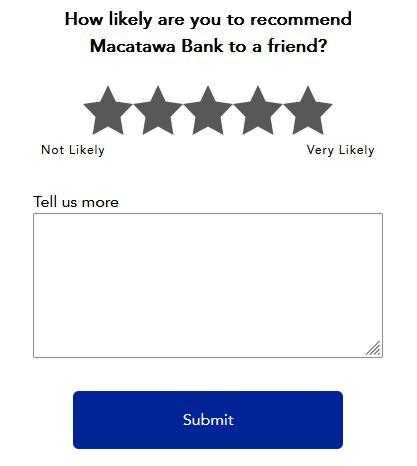

How do your customers generally feel about your financial brand? Are they satisfied enough to recommend it to others?

A Net Promoter Score (NPS) illustrates it very well. It is based on a single question: How likely are you to recommend us on a scale of 0 to 10?

It may also be a star-rating system, just like it is on the Macatawa Bank’s website.

Checking NPS in insurance services and other financial institutions has become a new norm. For example, it’s one of the primary metrics for UniCredit Group to measure customer experience, based on the report. In 2022, their NPS was as high as 60.

Feedback about a particular financial specialist

Suppose some of your employees provide the service so well (or, on the contrary, not very well) that your customers bring them under the spotlight.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

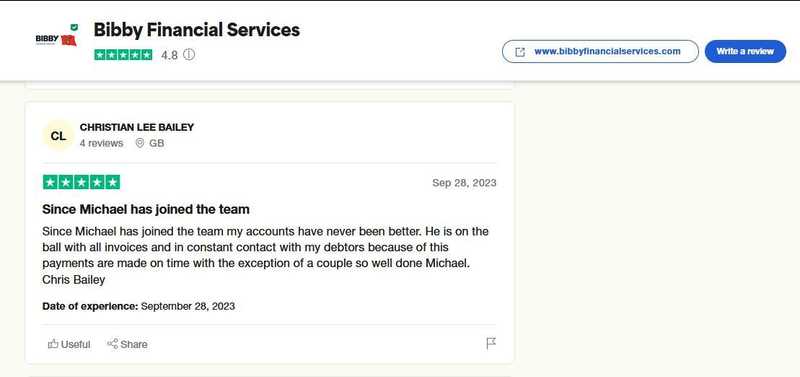

For example, check this positive review on Trustpilot dedicated to one of the invoice finance specialists working for Bibby Financial Services.

Feedback about financial services and products

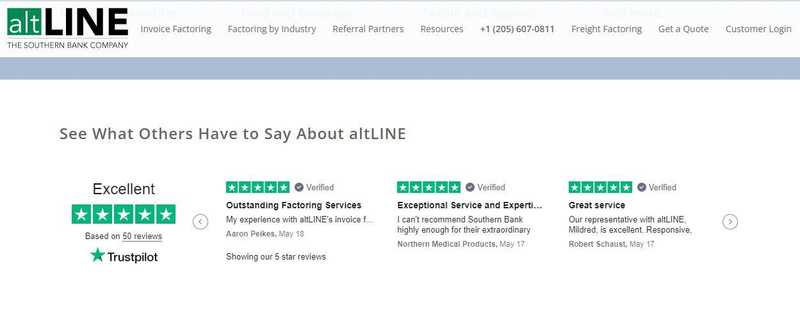

On the main page of altLINE Sobanco, you can read what customers say about the company’s services. Some reviewers give shout-outs to particular altLINE’s representatives, while others provide feedback about their invoice factoring tool.

Why Is Feedback Important for Customer-Centric Financial Brands?

Feedback’s role in finance is pivotal.

And here’s why.

By leveraging customer feedback correctly, you can do the following:

- Show that you value your clients and put them first

- Build customer trust

- Delve deeper into your client’s needs

- Provide a better user experience (on the website or in-app)

- Reduce churn

- Increase customer satisfaction

- Solve problems with the product/service in real-time

In fact, 89% of business leaders agree that instant customer input helps them grab opportunities and solve issues faster. Also, implementing AI contract review software enhances efficiency and accuracy in contract processes, demonstrating a commitment to meeting customer needs and ensuring regulatory compliance.

How to Use Feedback for Customer Centricity in Finance?

Begin a feedback-driven transformation of your financial brand with the following tactics.

Create a feedback loop

If you think that regularly asking How do you like our financial services so far is a customer feedback loop, we’ve got bad news for you. It is not. Regularity in gathering feedback is not even half the job done.

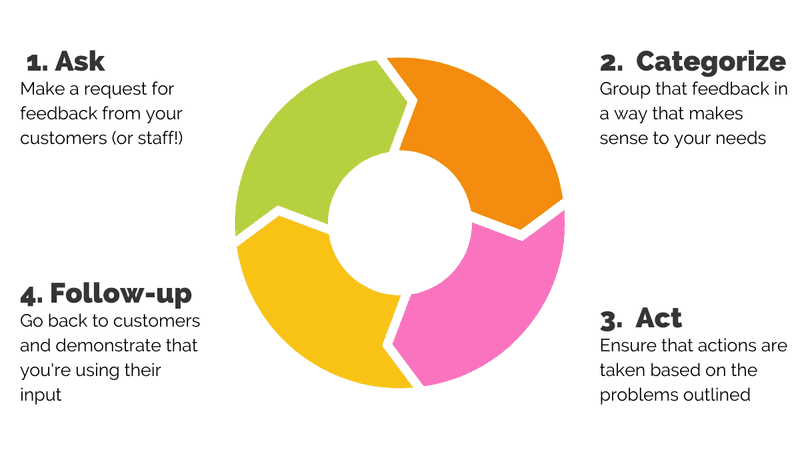

“A structural approach to designing a feedback loop helps always keep a customer in mind and in focus of the finance business. It can be done with the ACAF framework,” Brooke Webber, Head of Marketing at Ninja Patches. She explains further: “It presupposes four steps: requesting feedback, segmenting it, acting on it, and following up, and allows extracting more valuable insights from the collected feedback.”

Let’s have a clearer view of the four stages in the ACAF feedback loop:

- Ask – request customers to share their opinions

- Categorize – divide the information into logical groups or clusters and analyze them

- Act – prepare a response (if applicable) and implement the changes based on the gathered data

- Follow up – go back to your customers so that they know they are being heard

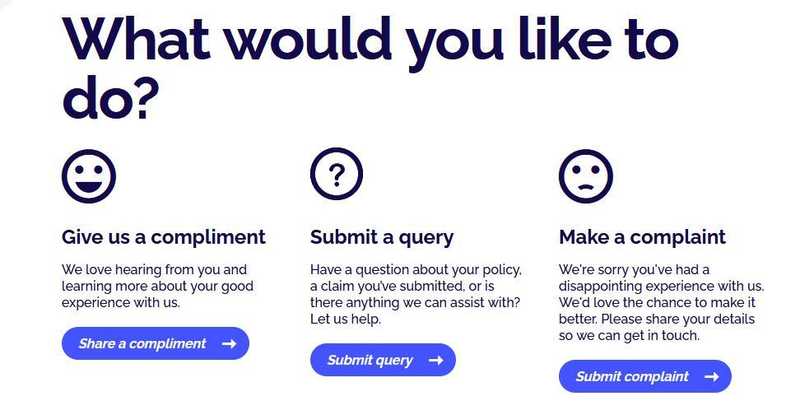

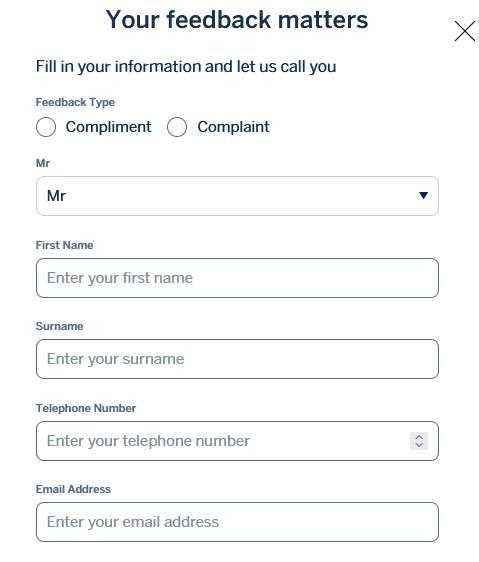

You can segment customer feedback right during the collection stage. For example, Momentum Metropolitan offers three options on the feedback page: Share a compliment, Submit a query, and Make a complaint.

Diversify your feedback collection methods

Anything from the below list is suitable for collecting customer feedback in the financial industry:

- Survey

- Feedback form or widget

- Review site

- Usability test

- Focus group

- Interview

This section will outline three fundamental methods: surveys, feedback forms, and reviews.

Surveys

Consider the following survey types for getting client feedback in finance, depending on every specific need:

- Product feedback survey

- In-app survey

- CSAT survey

- NPS survey

- CES survey

- Customer support survey

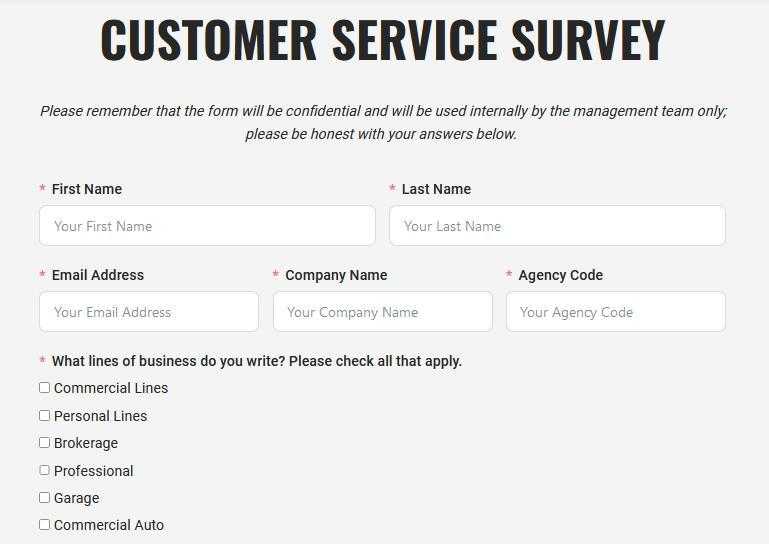

Take a glimpse of this customer service survey at Colonial General Insurance Agency.

Below is one more example of an online survey on the web page of Veridian Credit Union.

Bonus read: When to use CSAT, NPS, and CES surveys.

Feedback forms

Some customer feedback tools offer customizable widgets and forms to help you capture feedback on your financial website.

Check out this feedback form at Stanbic IBTC Insurance Limited.

Online reviews

How can you generate more customer reviews?

There’s a sure-fire method: ask your clients to say a few words about you on Google and review sites like Trustpilot, Better Business Bureau, and G2.com (for SaaS customer feedback).

For example:

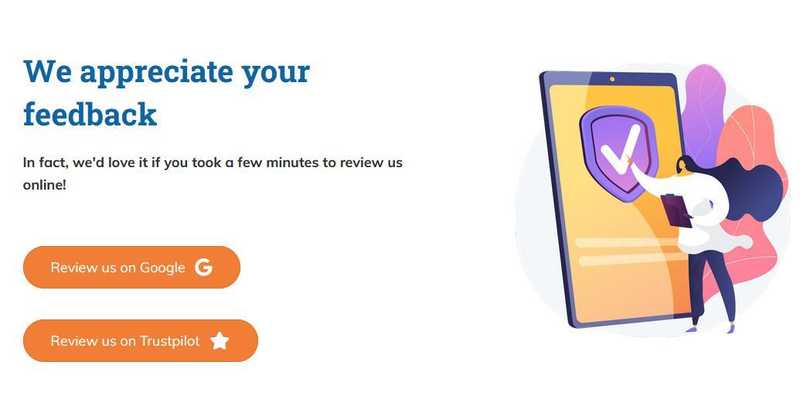

InsuranceHub offers two links for clients to leave reviews on Google and Trustpilot.

Bonus read:

Here is a case study of how SurveySensum helped PineLabs combine different methods for gathering customer feedback in FinTech: in-app surveys, digital surveys via WhatsApp, and computer-assisted telephonic interviews (CATI surveys).

Gather omnichannel feedback across various touchpoints

Over to where and when to collect feedback from your customers in finance.

Where: On every possible platform.

When: In real-time, at every stage of your customer journey.

See how various financial businesses capture client feedback via different digital platforms: website, blog, email, and social media channels.

Website

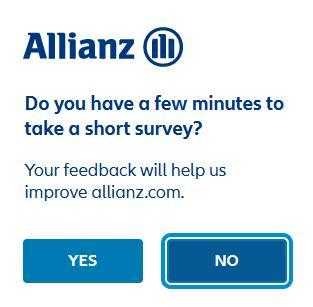

Allianz, an insurance agency, pops up with a survey to improve the user experience on the website.

Blog

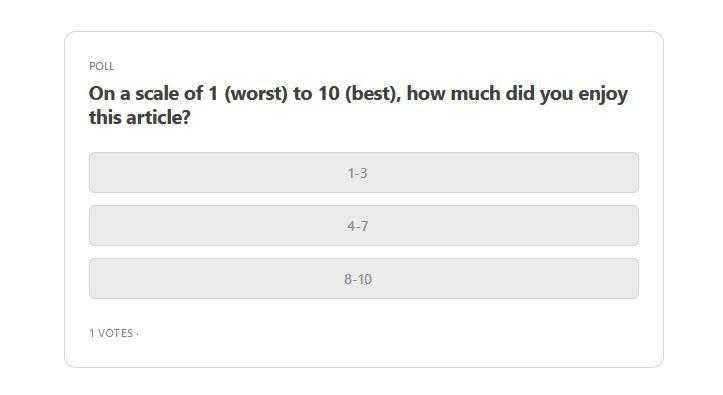

Aaron Pek asks readers to rate his articles on a scale of 0 (worst) to 10 (best) on the Value Investing Substack blog.

It can be as simple as placing feedback emojis in your email newsletter to help you understand whether your audience likes the financial information you share. This method is frequently used by The Motley Fool in emails: How did you like this email?

Social media

OceanFirst Bank shared a survey link in the Facebook post, asking clients to help them improve their ATMs.

Or

Here’s a review request Eastside Insurance Services posted on LinkedIn.

You can also take advantage of WhatsApp surveys, LinkedIn or Instagram polls, direct messages with feedback requests, etc.

Encourage customers to speak up with solid calls-to-action (CTAs)

“A powerful call-to-action is necessary to drive more feedback about a product or service in finance. A CTA alone can compel more financial clients to voice their opinions, especially if it has an emotional appeal,” emphasizes Catherine Schwartz, Finance Editor at Crediful.

We’ve rounded up several compelling CTAs popular among financial businesses:

- Could you help us out? Take our X-minute survey to

- Have your say. We’d love to hear from you!

- Take a survey to help us improve our services

- Your voice matters! Let us know what we are doing well or not so well

- Please give us your feedback

- Tell us what you think

For example:

Real Estate Guys appeal to emotions and call to action in a humorous way: Ask a question…report a problem…share your favorite recipe…

React to negative sentiment as soon as possible

When responding to customer feedback, you should prioritize negative comments about your financial services or employees.

“If you leave customer complaints unaddressed, they may result in legal trouble and end up in court,” remarks Stephan Baldwin, Founder of Assisted Living. “The most widespread cases leading to harmful reputational costs for financial companies are accusations of fraud, data privacy violation, or other consumer abuses,” he mentions.

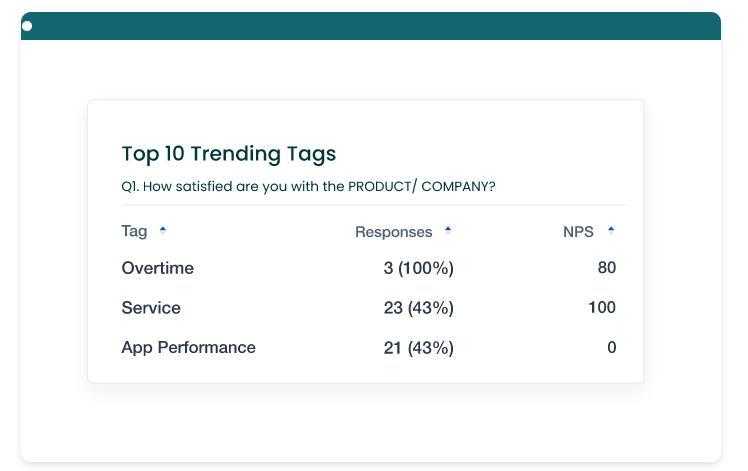

To avoid legal consequences and reputation damage, you can analyze customer sentiment in real-time and identify emerging complaints with SurveySensum’s text analytics software. Keep an eye out for negative trending tags in answers and comments from your clients.

Express gratitude and personalize your thank-yous

“A simple thank-you can demonstrate your appreciation of the clients’ effort and time spent on leaving feedback about your finance brand,” explains Jesse Galanis, Content Manager of Tech Lockdown. “People also feel more appreciated and valued for their input if they receive personalized thanks,” he adds.

Look at this thank-you message from Caribbean Capital Group for completing the survey.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

When taking too many surveys, people often experience survey fatigue. At this rate, a personalized and warm thank-you note can make the process more enjoyable and rewarding.

Make a Customer-First Finance Shift With Feedback

In the ever-changing world of finance, customer centricity through feedback is not just a strategy. It is a fundamental necessity that pays off in the long term.

It is all about prioritizing the unique wants and needs of the people you serve. With this guide in your bookmarks, you can do it more effectively now.