Intro

There have been many advantages to technology over the years, but one that stands out is the ability to solve complex personal finance problems using digital tools and calculators.

Implementing these calculators and tools into your website is a great way to improve the user experience and provide more value to your visitors for free. These tools can also be extremely advantageous in terms of getting traffic through Search Engine Optimization (SEO).

But with so many websites offering these tools, how do you make sure yours stands out?

Optimizing your calculators and tools to rank high on search engines is the best way to drive traffic to the tools and to make sure your visitors are using it.

In this guide, we'll talk about how to make your personal finance tools easy to find and use.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

We'll cover topics like what users are looking for, the best ways to use keywords, and how to make your tool's page look good to search engines.

Whether you run a website, write content, or just want to learn about SEO, this guide has helpful tips for you.

Understanding the User's Needs

When people go online to use a finance tool or calculator, they usually have a specific question in mind.

Maybe they want to know how much they'll pay each month for a car loan, or perhaps they're curious about how long it will take to save up for a dream vacation.

Understanding your user’s search intent is the first step to making sure they find and use your tool.

Here are some things to consider when making your personal finance tool:

- Common Financial Questions: Think about the typical questions people have about money. Some might wonder how interest works on a savings account, while others might want to compare two loan offers. By knowing these common questions, you can design your tool to give specific answers when given certain inputs.

- Easy-to-Use Design: Once a user finds your tool, you want them to use it! Make sure it's simple and straightforward. If it's too complicated, they might leave without getting the answers they came for.

- Quick Answers: People value their time. If your tool can give them a quick answer without making them click through many pages or fill out long forms, they're more likely to use it and come back in the future.

In short, the key is to put yourself in the user's shoes. Think about what they want, what questions they have, and how you can help them get answers easily and quickly.

Remember, there is nothing more important than user experience when creating something they will use. You want to make sure it represents your brand well!

Keyword Research for Finance Tools

When people have a money question, they often turn to search engines for answers.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

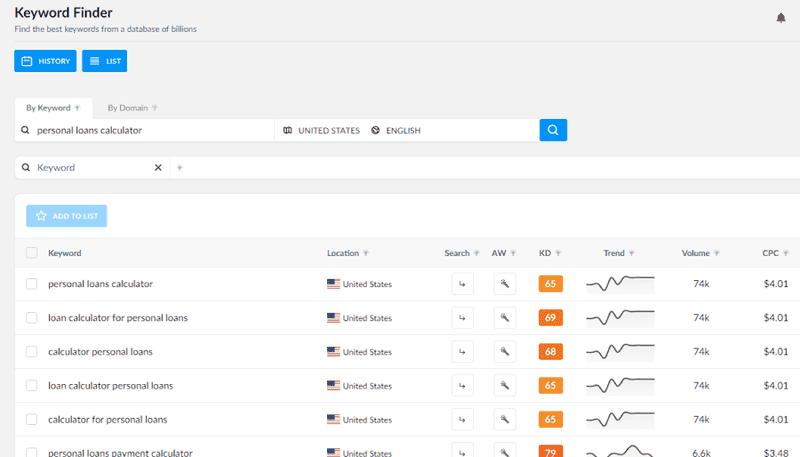

They might type in things like "home loan calculator" or "personal loan calculator."

These phrases are called keywords, and they're a big part of how people find your finance tool online.

Here's how to do keyword research for your finance tools:

- Use tools like Google's Keyword Planner and Rank Tracker’s Keyword Finder to see what phrases people are typing into search engines. This can give you a good idea of what your potential users are looking for and how much traffic the keywords get.

- Focus on specific keywords. Instead of just targeting broad terms like "loans," look for more specific phrases. For example, "how to calculate monthly loan payments" might lead users directly to your loan calculator.

- Use long-tail keywords. These are longer phrases that people might search for. They might have fewer searches when compared to short-tail keywords, but they can bring in users who are looking for exactly what your tool offers. Phrases like "tips for saving money on a tight budget" can be gold for your finance tools.

Remember, the goal is to think like your users. What are they searching for? What words or phrases might they use?

By understanding and targeting these keywords, you can make sure your finance tools show up when and where they're needed most.

On-Page SEO Best Practices

Once you've figured out the right keywords, it's time to make sure your finance tool's page is set up to rank well in search results.

This is where on-page SEO comes into play. It's all about making sure your page looks good to search engines and users alike.

Here are some best practices to keep in mind:

- Clear Titles and Descriptions: Your page title should clearly describe what the tool does. Also, add a short description that gives users a quick idea of what to expect. This can help your page stand out in search results.

- Use Schema Markup/Structured Data: This is a bit of code that helps search engines understand what's on your page. For tools and calculators, schema markup can highlight key features and make your page more noticeable.

- Fast Load Times: No one likes waiting for a slow page to load. Make sure your tool loads quickly, especially on mobile devices. This can improve user experience which is a huge ranking factor for Google.

- Mobile-Friendly Design: Along the same idea as the load times, many people search on their phones or tablets. Ensure your finance tool looks good and works well on all devices. A responsive design can adjust to different screen sizes and make your tool easy to use everywhere.

On-page SEO is more than just getting users to your page. It's about giving them a great experience once they're there.

Content Surrounding the Tool

Having a great finance tool or calculator is essential, but the content around it plays a crucial role too.

This content helps users understand the tool better and provides additional value that can keep them engaged and coming back for more.

If you have a mortgage calculator, for instance, include content about how mortgages work, the different types of mortgages, and tips for getting the best rates. This not only helps users but also positions your page as a go-to resource.

Make sure users know why they should use your tool with your content. What problem does it solve? How can it help them make better financial decisions? A clear explanation can encourage more users to try it out.

If you have other related tools or articles on your site, link to them. This can guide users to more of your content and keep them on your site longer. For example, someone using a savings calculator might also be interested in tips for budgeting.

Finally, some people are visual learners. Consider implementing a video to walk users through how to best use the tool. This is especially important if the tool is a bit more complex.

The content you include should provide the users with as much related information as possible to make sure they get the most out of the tool.

Engaging Users and Encouraging Interaction

A great finance tool can attract users, but keeping them engaged and encouraging interaction can make all the difference.

The more users interact with your tool and website, the more value they derive, and the more likely they are to return or recommend it to others.

One thing you can do to make sure the tool is engaging is by adding interactive features like sliders for input values and graphs that update in real-time.

Make sure you give a user an objective after using the tool. Having a clear CTA (Call to Action) is a great way to encourage users to take the next step.

A good CTA for a personal finance tool can be an article that gives more details about the topic, a link to a consultation with an expert, or a resource on how they can apply what they learned from the tool.

It might also be a good idea to add a feedback mechanism so the user can give you feedback on the tool and its effectiveness. A simple like/dislike button should do.

And finally, similar to the feedback mechanism, it would also be a good idea to give the user an easy way to share the tool with friends and family.

Look for ways to make the tool more interactive so the user actually gets value from it. You want your tool to be almost the top of the funnel of your website. Give them an enjoyable experience and provide them with clear instructions (CTAs) on what to do next to get the most out of the tool. Offering niche-specific tools, such as the DSCR calculator, encourages deeper user engagement, particularly for those interested in real estate investments and evaluating potential rental properties.

Case Study: Money4Loans' Personal Loan Calculator

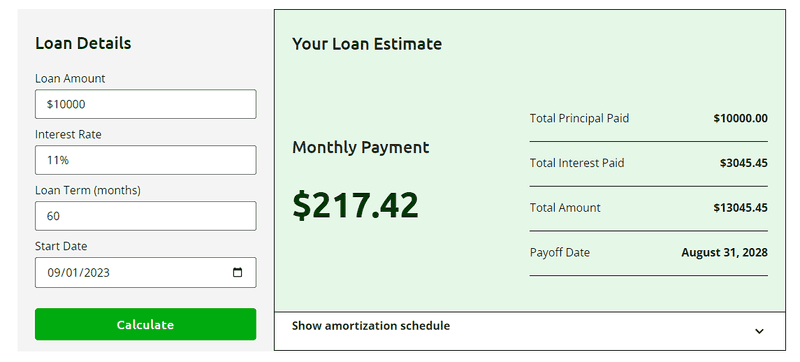

Money4Loans has an excellent example of what a digital personal finance tool should look like.

Let’s take a look at what their tool looks like and how it helped their website get more traffic.

Website: Money4Loans

Tool: Personal Loan Calculator

Strategies Employed by Money4Loans:

- Clear Description: The tool's page offers a precise description, emphasizing its purpose and ease of use. This not only aids user understanding but also boosts its visibility in search results.

- Educational Content: Beyond just calculations, the page educates users about amortization schedules, adding depth and value to the user experience.

- Guidance on Usage: Users aren't left to interpret results on their own. The site provides insights on understanding the calculator's outputs, guiding users in their financial decisions.

- Internal Linking: By linking to related content, Money4Loans creates a network of valuable resources, enhancing user engagement and SEO simultaneously.

- User Engagement: The interactive design of the calculator ensures users spend quality time on the page, a positive indicator for search engines.

The Results:

The combination of the tool with educational content ensures users not only get results but also understand them. This has helped with user experience and engagement, resulting in users staying on the website longer.

The use of appropriate keywords and descriptions has helped bring traffic to the website through search engine rankings.

Take Money4Loans’ tool as an example of how to structure your digital personal finance tools. Make sure you are keeping the user’s experience top-of-mind and using the on-page elements to rank higher on search engines.

Challenges in Optimizing Finance Tools for Search

While the benefits of optimizing finance tools for search are clear, the journey isn't without its hurdles.

As search engine algorithms evolve and user behaviors shift, websites face a set of challenges in ensuring their tools remain both functional and visible in search results.

Here are some challenges to consider:

- Changing Algorithms: Search engines, especially Google, frequently update their algorithms. What works today in terms of SEO might need adjustments tomorrow.

- Balancing User Experience with SEO: While SEO is essential, it shouldn't come at the cost of user experience. Ensuring that finance tools are easy to use while implementing SEO strategies can be difficult to balance.

- Technical Issues: As tools become more complex, there's a risk of technical glitches. Slow load times, broken links, or non-responsive designs can harm both user experience and SEO.

- Competition: The online space is crowded, with many websites offering similar finance tools. Standing out and ensuring your tool is the go-to choice requires continuous effort and innovation.

- Keeping Content Updated: Financial information and guidelines can change. Ensuring that the content surrounding the tool, as well as the tool's data, remains current is essential for credibility and trust.

While these challenges do exist, they should not discourage you from creating an outstanding tool for your users. We hope that this guide will help you create an excellent and optimized personal finance tool.

Conclusion

Having financial tools on your website is one of the best ways to stand out from the competition. Even if your competition has similar digital tools, implementing them on your website is a great way to get more traffic to your site.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Knowing how to apply SEO to your tool is important to make sure that your tool ranks high on search engines and actually brings in the traffic you are looking for.

From understanding what users are searching for to ensuring your tool's page is fully optimized, there's a lot to consider. And as we've seen, even successful tools face challenges and need to adapt constantly.

But the effort is worth it. A well-optimized finance tool can attract more users, provide valuable insights, and even become a trusted resource for many. It's not just about rankings or traffic; it's about helping users make informed financial decisions.

So, for all those involved in creating or promoting personal finance tools, remember: SEO is a journey, not a destination. It requires continuous learning, testing, and refining. But with dedication and the right strategies, your tool can shine in search results and truly make a difference in users' lives.