Intro

For many entrepreneurs, starting a business is a dream come true. Unfortunately, getting the money to fund a business venture can be a significant hurdle. Whether you are launching a new company or expanding an existing one, you need new sources to help your business grow. This short guide outlines common avenues of funding for businesses.

While starting a business can be challenging, you can make the process more manageable with the right approach and budget. Read on and learn how you can secure funds to grow your business and achieve your goals for your new startup.

How To Get More Funds for Your Startup Idea

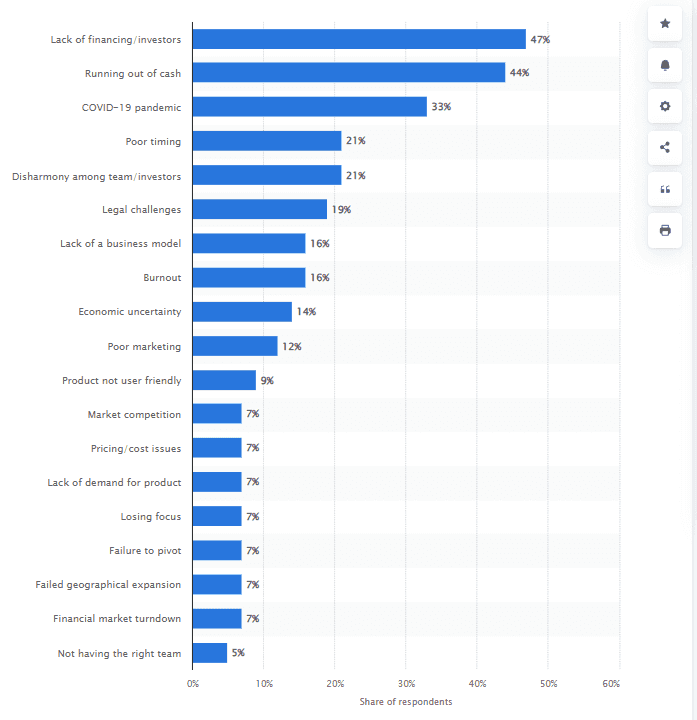

According to a survey about why startups fail, lack of investors for funds is the most cited cause. New entrepreneurs aspiring to see their businesses succeed must find reliable funding avenues to keep their startups competitive and profitable.

Startup failure reasons worldwide in 2022 from Statista

This section outlines different ways entrepreneurs can get funds for their startups. After reading, you can develop a financial plan to help you start your venture or keep your business afloat.

Pursue grants

Government agencies, companies, or philanthropists award grants to businesses to stimulate the economy. Grants are free money that you do not have to pay back.

Through grants, organizations can create jobs, support projects that traditional lenders cannot financially back, and boost economic benefits for local communities.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

However, due to the appeal of free financing, the competition for grants can be tight. Small business grants are awarded to startups in specific industries, certain regions or sectors, or particular community groups.

These funds can be as small as a few hundred dollars to hundreds of thousands. However, most grants do not exceed $10,000, making them suitable only as a supplement to other types of small business funding.

If you want to apply, you can check out grants from nonprofits and regional government agencies. You can even look for grants at state and local levels, starting with the following:

* Small Business Development Center

Your local Small Business Development Center (SBDC) supports aspiring entrepreneurs and small businesses. The program is often associated with a state’s economic development agency or local universities.

Through SBDC, you can easily find where to apply for small-business grants and other business financing opportunities. Aside from this benefit, you can receive counseling, training, and technical assistance.

* State Trade Expansion Program

The Small Business Administration (SBA) allocates funds for state governments to implement State Trade Expansion Program (STEP) grants. With STEP, local government agencies can help small businesses start or expand into international markets.

* Economic Development Administration

The US Economic Development Administration offers resources, business grants, and technical support for communities. The agency aims to support economic growth and encourage innovation and entrepreneurship.

Each state’s agency helps entrepreneurs find business funds, get locations, and recruit workers. If you want to learn how the administration can help you, visit the economic development directory for local resources and regional offices.

* Minority Business Development Agency centers

The Minority Business Development Agency (MBDA) operates a national network of business centers that help grow and advertise minority-owned small businesses. These centers help business owners get capital, compete in emerging markets, and secure contracts.

The available funding amounts and eligibility criteria under these grants vary depending on your state. However, you can use the capital to design international marketing products, participate in export trade shows, and support website globalization.

Try crowdfunding

Crowdfunding is another funding strategy entrepreneurs can try to get additional capital for their startups. This tactic creates opportunities for business owners to raise hundreds of thousands, even millions, from any donors willing to invest.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

It can benefit entrepreneurs with their hands full of other financial responsibilities, preventing them from funding their own startups. They may be in the middle of trading their old mortgage or saving up for big purchases.

Another advantage of crowdfunding is it is now easier than ever to reach out and ask for donations from investors worldwide.

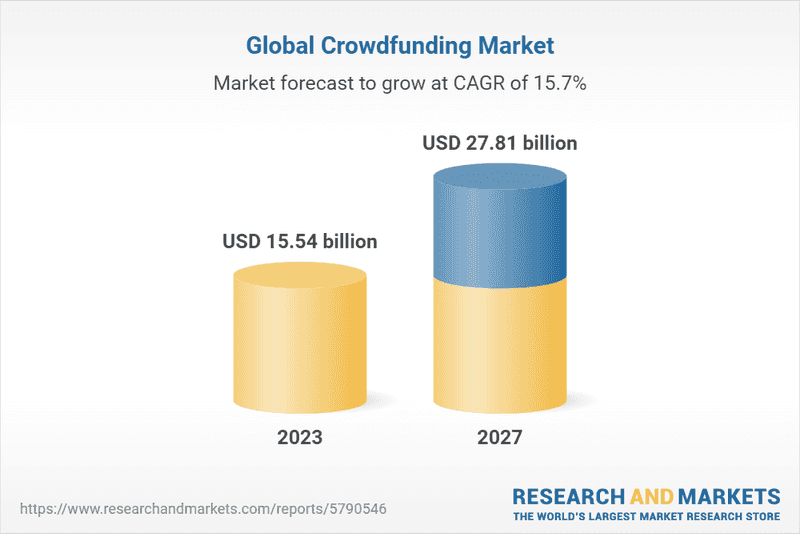

In 2023, the market reached a $15.5 billion valuation, with an annual growth rate of 16 percent. At this rate, the sector could be worth $27.8 billion by 2027. Innovation is one of the main driving forces in the growth of the crowdfunding market. Major industry players are focusing on tech advancements to strengthen their position and offer better solutions to consumers.

Image from Research and Markets

Because of the expected growth within the sector, more investors will be encouraged to support new business ventures. This advantage creates opportunities for entrepreneurs looking for financial backing.

There are several crowdfunding platforms you can use to start your business. Here are four of the top sites you can use to ask for donations from investors:

- Kickstarter

- LendingClub

- GoFundMe

- Indiegogo

Crowdfunding your next business venture can be an easy way to raise money. However, you must first determine which type of crowdfunding is best for your startup and what it requires. The following are the most common types of crowdfunding:

- Donation crowdfunding - If you want to start a local business, you can try donation-based crowdfunding. This process requires you to create a campaign asking for donations for your new business, and anyone can donate money.

- Equity crowdfunding - This practice involves selling a share of your business to an investor or group, and they provide you with the funds to expand your business.

- Rewards crowdfunding - This type of crowdfunding rewards donors with different products, services, or other gifts in exchange for a specific donation amount.

- Debt crowdfunding - This process involves borrowing money from individuals instead of traditional lenders, like a bank. You can borrow at a set annual percentage rate, and debts are designed like conventional business loans.

Look for venture capital firms

Venture capital (VC) firms raise money from investors and use the funds to support risky startups. These companies get profit after a startup exits, sells at a premium, or goes public, making the company’s shares tradable.

Because early-stage investing can be a high-risk game, this funding option only works for certain types of businesses. If your startup does not have the potential to be immensely profitable, getting support from a VC can be challenging.

Most importantly, you must understand that when you take money from a VC firm, you are committing yourself and your business to a path of fast growth. Moreover, you will have to give up a substantial share of your business in return for the investment.

A partnership with a VC firm will not only get you funding. It can also introduce your business to the right networks, provide advice on how to grow and scale your company, and share expertise.

Find angel investors

An angel investor can give the initial seed money to startups in exchange for ownership equity in the company. Other names for angel investors include informal investors, private investors, angel funders, seed investors, or business angels. They can be involved in a series of projects purely professionally, or they can even be friends or family members.

Angel investors can provide a one-time infusion of seed money or offer ongoing injections of funds to help a startup introduce a product to the market. The money they provide is not technically a loan. Most investors put stakes into a business idea they are passionate about, expecting a reward only if the business becomes profitable.

Angel investors are wealthy individuals seeking opportunities for a higher rate of return than those from traditional investments. They hunt for startups with intriguing ideas and invest their own money to help the company expand.

If you choose to work with angel investors, you will have to give them an equity stake and a seat on the board in return for their investment. With their financial backing, your startup can take its first steps.

When looking for an angel investor, keep the following tips in mind:

- Be thorough when checking their references

- Make sure they are not backing your competitors

- Find out if they have valuable contacts who can become future partners or investors

- Study their previous investments and find out which ones succeeded and which failed

- Determine if their planned level of business involvement suits you

Bootstrap

Bootstrapping refers to the process of using existing resources to start or grow a company. These resources can include personal computing equipment, personal savings, and even a garage space.

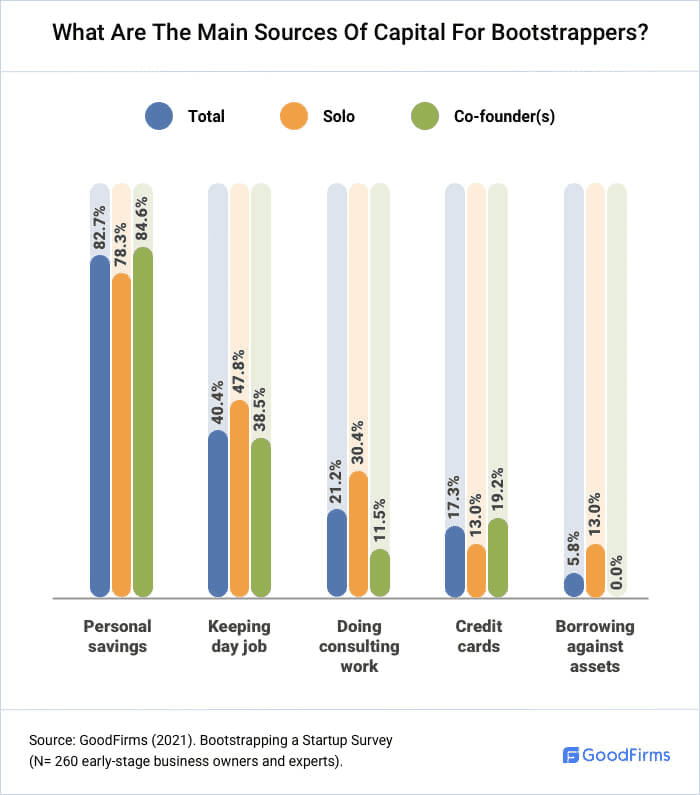

Image from GoodFirms

In a survey about the primary sources of capital for bootstrappers, 78 percent of solo entrepreneurs used their savings to fund their businesses. Other sources include day jobs, consulting work, and credit loans.

This approach is in contrast to looking for investors who will provide capital or applying for loans to fund a business expansion. Bootstrapping is all about stretching what you already have to reach specific goals for your company.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Bootstrapped founders rely solely on personal savings, lean operations, sweat equity, and quick inventory turnover to make their business a success. Instead of applying for business loans, bootstrappers choose to fund their own startup using their own money.

For example, a bootstrapped startup may take preorders for its new product and then use the payment to deliver it to customers. Another example is an entrepreneur spending their own money to pay for their startup’s sales, operations, and marketing expenses, such as email forwarding service fees, employee salaries, and business taxes.

Compared to looking for venture capitalists, bootstrapping can be better because the entrepreneur can keep control over all decisions. However, this tactic also places unnecessary financial risk on the business owner. Moreover, it may not provide enough capital for the company to become successful in the long run.

Get the Funds You Need for Your Business Idea

Securing funding for your new startup is essential for growth. Today, there are several ways to do that, and by carefully considering all the options, you can end up with the right funding source for your company.

The key is to find the perfect funding source that aligns with your goals. Make sure to have a solid plan, and remember that the approaches have pros and cons. If you want the best funding strategy, do your research and compare their advantages and disadvantages before making a decision.