Intro

In today's fast-paced business environment, staying competitive means embracing technological advancements. One of the areas where technology has made significant improvement is Financial Process Automation (FPA).

It’s estimated that about 80% of financial processes have the potential for automation. At the same time, only about one-third of companies claim that a portion of the operations in their financial departments are completely automated.

In this post, we delve into what financial process automation entails, its benefits, what processes can be automated, and how to start implementing FPA in your business.

What’s Understood Under Modern Financial Process Automation?

Financial process automation is the use of technology to automate key finance-related tasks. This involves using software tools that can handle repetitive and time-consuming tasks without human intervention, thereby increasing efficiency and accuracy.

The aim of FPA is not to replace financial professionals but to enable them to focus on more strategic tasks by freeing them from routine work. The benefits of this approach are listed in the below section.

What Are the Benefits of Finance Automation?

Automation in financial services benefits the company and its employees in a number of ways. Here are the major of them:

- Increased efficiency. Automation significantly speeds up financial transactions and minimizes manual handling, resulting in faster processing for invoicing, payroll, and financial reporting.

- Accuracy and compliance. Automated systems reduce human error, ensuring more reliable financial records. They also assist in keeping up with complex financial regulations.

- Cost reduction. Automation in finance reduces the need for extensive manual processing, thereby cutting labor costs and preventing expensive errors.

- Enhanced decision-making. Access to real-time financial data and analytics enables businesses to make well-informed decisions swiftly.

- Scalability. Automated systems can easily adjust to increased workloads, allowing businesses to grow without a corresponding increase in financial staff.

- Improved employee satisfaction. Actually, few employees enjoy performing tedious tasks that don’t allow them to express their very best expertise or creativity. Ruling such processes out can impact the mental status of employees positively.

In short, automation in financial processes is not just an operational upgrade but rather a strategic necessity for staying competitive in today’s business environment.

In case you don’t have a team of fintech software developers in-house, you’ll likely require external assistance for you to reap all the benefits of automation. A trusted provider of fintech custom software development can advise on and conduct necessary research, planning, and implementation. Requesting outsource fintech development services is the right call for most companies seeking scalable and investment-effective financial software development that doesn’t disrupt existing processes but rather enhances them.

Now let’s proceed with reviewing what processes exactly you can automate to a high extend using finance automation techniques and tools. It’s important to note that it may not be possible to eliminate human involvement in all these operations completely. However, reducing the number of tedious and human error-prone processes can already bring significant advantages. ~~ ~~

What Can Be Automated in Finance?

There are several key areas in finance where automation can come of great value. These include:

- Invoice processing. Automation can help manage the entire invoice lifecycle from receipt through to payment, reducing processing time and minimizing errors.

- Expense management. Automated systems can streamline the processes of expense reporting, approval, and reimbursement, ensuring adherence to policies and faster processing times.

- Budgeting and forecasting. Automation tools can gather data from multiple sources for more accurate and timely budgeting and forecasting. This includes predictive analysis to foresee future financial conditions and trends.

- Financial reporting. Automation can generate comprehensive financial statements and reports rapidly, offering crucial insights into the company's financial health.

- Tax compliance. Automation ensures precise tax calculations and timely filings, mitigating the risk of incurring penalties. It can greatly assist accountants in their daily routine.

- Payroll processing. Automating payroll ensures accurate and timely compensation to employees, along with appropriate tax deductions and compliance with employment laws.

- Asset management: Tracking and managing assets, data for which is stored in multiple documents, become more efficient with automation, ensuring optimal utilization and cost-saving.

- Risk management and compliance: Automated systems can monitor and report on risks based on historical data for business processes and ensure compliance with various regulatory requirements.

Automating these and possibly other processes can greatly streamline the work of the financial department and make it more efficient.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

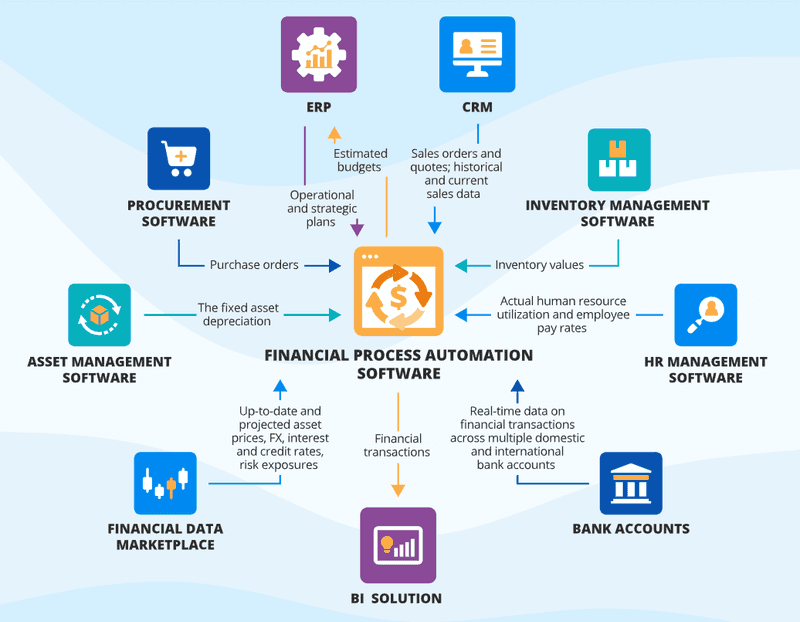

Examples of software solutions that can be used for finance workflow automation are provided in the image below:

Image source: https://www.scnsoft.com/financial-management/automation

Should you be interested in exploring modern software solutions for SEO teams, read another our blog post.

How to Start with Financial Automation?

Regardless of the process you intend to automate or the software solution you’ll adopt for finance automation, you need to undergo a particular procedure to handle this intervention right. Here is the step-by-step process for implementing automation in finance department:

- Identify your current processes. Begin by evaluating your current financial processes to discover areas prone to inefficiency or error. This assessment will guide you in pinpointing operations that will benefit most from automation.

- Define clear goals for intended finance automation. Set specific objectives for what you aim to achieve with automation, be it cost reduction, enhanced accuracy, or improved compliance.

- Select appropriate software solutions. Investigate and choose financial process automation tools that align with your business needs. Key considerations should include scalability, compatibility with existing systems, user-friendliness, and vendor support.

- Invest in training. Educate your team about the new systems. Personalized digital education and training of staff is crucial for a smooth transition and to fully leverage the benefits of automation. This project stage will likely go in parallel with implementation.

- Plan for integration and implement it in phases. Ensure the possibility of seamless integration of automation tools with your current systems, such as ERP or accounting automation software, to avoid operational disruptions. Then, start by automating a few processes and gradually expand. This phased approach allows your team to adjust to the new technology comfortably.

- Monitor and adapt. Continuously evaluate the performance of your automated systems and make necessary adjustments. This will help you tailor the operation of the adopted software for your processes better and ensure the high performance of teams working with it.

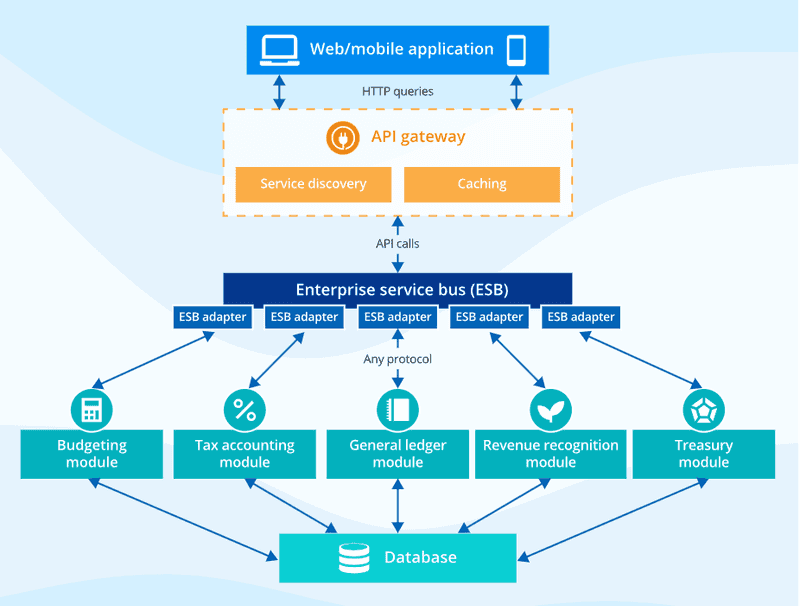

You can familiarize yourself with one of the software designs of a custom-made highly integrated financial application for automation in the infographics below:

Image source: https://www.scnsoft.com/financial-management/automation

There is a range of other possible approaches to implementing financial automation in your digital infrastructure. Without in-house expertise, you’ll likely need to contact a provider of fintech app development services to set everything up.

Final Take

The adoption of financial process automation is nearly a strategic imperative for businesses aiming for efficiency, accuracy, and growth. By automating routine financial tasks, companies can redirect their focus and resources toward strategic planning and growth initiatives.

By determining key processes to automate, developing and integrating a corresponding software solution, and training teams on working with it, businesses can achieve new heights of efficiency in their finance departments.