Intro

Curious about options trading and leverage but not sure where to start? These concepts may sound intimidating, but don’t worry—we’ll break it down for you in simple terms. If you're also looking to join a trading community, there are some of the best options trading Discord groups that can offer support and insights as you navigate this journey.

Understanding these tools can help you maximize your potential gains in the stock market. So, grab a seat and get ready to learn the basics of options trading and leverage in this beginner-friendly overview.

So, grab a seat and get ready to learn the basics of options trading and leverage in a beginner-friendly overview.

Understanding Options Trading and Leverage: A Beginner's Guide

Leverage in options trading refers to the strategy of using borrowed capital to increase the potential return on investment. When a trader uses leverage, they are able to control a larger position in the market with a smaller amount of capital.

For example, if an investor buys an option contract for $500 with a leverage ratio of 10:1, they would only need to put up $50 of their own capital. This amplifies both gains and losses, so it is important for beginners to understand the risks involved.

Beginner traders can identify entry and exit points by conducting technical analysis on the underlying security, looking at price movements, and considering market trends. Developing a trading plan that includes specific criteria for entering and exiting trades can help beginners stay disciplined and avoid emotional decision-making.

Options trading offers the benefit of limited downside risk through the purchase of a put option or using strategies like covered calls for downside protection. However, options trading also carries risks such as the potential loss of the entire premium paid, especially if the option expires out-of-the-money. It is essential for beginners to carefully consider these factors before investing in options as part of their portfolio.

Basics of Options Trading

Definition of Options Trading

Options trading services involves buying and selling contracts. These contracts give the trader the right to buy or sell a stock at a set price within a specific time. Unlike traditional stock trading, where actual shares are bought and sold, in options trading, traders pay a premium for these contracts.

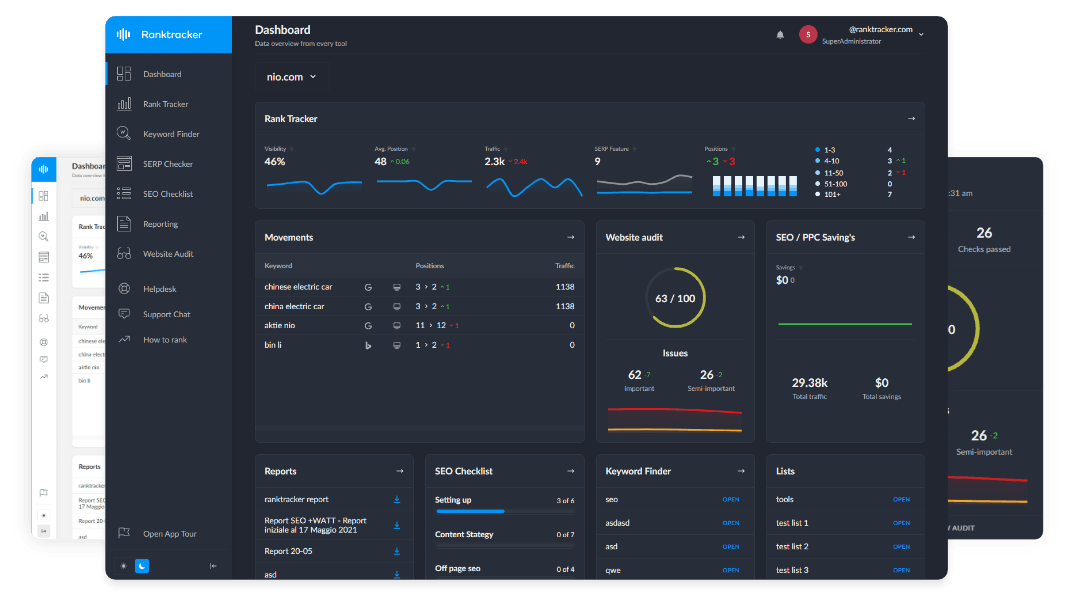

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

The risk in options trading is limited to the premium paid for the contract. This setup provides protection against potential downside for investors. Leverage is a significant factor in options trading. It allows traders to control a larger position with less capital.

While leverage can increase potential returns, it also raises the risk of capital loss. Traders can use leverage to implement strategies like covered calls or protective puts to hedge against losses in their current positions.

Understanding the expiration date, strike price, and moneyness of an option is crucial for making informed decisions when trading options. Effective portfolio management also relies on this understanding.

Types of Options

There are two main types of options available for trading: call options and put options.

Call options give the trader the right to buy shares of a stock at a specified price (strike price). Put options, on the other hand, give the trader the right to sell shares at a specified price.

Each type of option has its own premium that the trader must pay to purchase the option contract. The risk in options trading comes from the potential loss of the premium paid.

Investors can choose the most suitable type of option for their trading strategies based on their market outlook and risk tolerance. For example, a trader who believes a stock will rise in price may choose a call option, while a trader who expects a stock to fall may opt for a put option.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

By understanding the characteristics of different types of options and how they align with their investment goals, traders can effectively utilize options trading to enhance their returns and manage risk in their portfolios.

Key Terms in Options Trading

Options trading involves trading contracts giving traders the right to buy or sell securities at a set price before the contract ends. Knowing key terms is important to navigate this market effectively.

Types of options like call options, put options, covered calls, and protective puts affect trading strategies. They help with risk management, income generation, or market speculation.

Common terms include strike price, premium paid, intrinsic value, moneyness, expiration date, and net option premium.

As leverage amplifies potential returns and risks, understanding how leverage works in options trading is crucial. Leverage lets traders control a larger position with less capital but can lead to bigger losses if the trade goes wrong.

Traders should assess leverage’s impact on their decisions to manage risk and reach their investment goals in options trading.

Common Options Trading Strategies

Long Call

A Long Call option strategy involves investors purchasing a call option on an underlying asset, such as a stock, at a specific strike price. The goal is for the market price of the asset to go above the strike price before the option expires.

This strategy lets traders profit from the asset's price increase without owning the shares. By paying a premium for the call option, traders gain the right to buy the asset at the strike price. This provides leverage and the potential for high returns.

Investors using a Long Call strategy can benefit from exposure to the market with limited downside risk. The most they can lose is the premium paid for the option. This strategy is great for bullish investors who expect the asset's price to rise.

Long Put

A long put option is a type of options trading strategy. In this strategy, a trader buys a put option on a specific underlying security.

The put option gives the trader the right to sell the underlying asset at a predetermined price (strike price) before the option's expiration date. But, the trader is not obligated to do so.

Investors use this strategy when they expect the price of the underlying asset to decrease.

Benefits of a long put strategy:

- Limited downside risk

- Maximum loss is capped at the premium paid for the option

- Provides downside protection if the market price falls

Risks of a long put strategy:

- Market price may not decrease as expected

- Loss of the premium paid if the price doesn't move as anticipated

Trading options, including the long put strategy, can offer leverage and potentially increase returns. However, it is important for investors to be aware of the risks involved before adding them to their investment portfolio.

Bull Call Spread

A Bull Call Spread is an options trading strategy. It involves buying a call option and selling another call option with a higher strike price. Both options have the same expiration date.

This strategy benefits traders with a bullish market outlook. It leverages the price movement of the underlying asset. Traders profit from the difference in premiums paid and received.

However, there are risks involved. These risks are mainly linked to the stock price not aligning with the trader's expectations. If the stock price doesn't rise as expected, losses may occur due to the premium paid for the call option.

Moreover, the downside protection in a Bull Call Spread is limited. If the market price of the security drops below the call option's strike price, losses can be significant.

Bear Put Spread

A Bear Put Spread in options trading involves buying a put option. Simultaneously, it involves selling another put option with a lower strike price on the same underlying security.

Traders use this strategy to profit from a moderate decrease in the asset's price. It helps limit risk exposure compared to just buying a put option outright. This strategy offers limited downside protection while still allowing for potential gains if the stock price drops.

Compared to other options trading strategies like a long put or a protective put, the Bear Put Spread allows investors to reduce the premium paid for the options contract by selling a put option as well. This can lower the overall cost of the trade and improve potential returns.

Using a Bear Put Spread is advantageous when investors have a bearish outlook on the market or a specific stock. It can be effective when the goal is to capitalize on a potential decline in the market price of the underlying asset while maintaining limited risk exposure. Additionally, the Bear Put Spread can be part of a larger trading plan to manage downside risk and enhance returns in a portfolio.

Straddle

A straddle in options trading involves buying a call option and a put option at the same strike price and expiration date for the same underlying security.

This strategy is used when the trader expects significant stock price movement but is unsure of the direction.

With a straddle, the trader can benefit from price movements beyond the strike price plus the net option premium paid.

This setup allows for unlimited returns if the stock price moves significantly, while capping the downside risk at the premium paid for the options.

For instance, if a trader anticipates a big earnings announcement that could shake the stock price, a straddle can help profit from market volatility, regardless of the stock's direction post-announcement.

Strangle

A strangle strategy in options trading involves buying or selling both a call option and a put option on the same underlying asset.

They have different strike prices.

Traders use this strategy to benefit from significant price movement without needing to predict the direction.

A strangle is distinct from a straddle strategy because the call and put options have different strike prices.

This provides the trader with more flexibility in potential profit.

Traders often opt for a strangle when expecting a large price movement but are uncertain about the direction.

It offers limited risk with the chance for high returns if the market moves significantly.

Investors who want to safeguard an existing position use a strangle for downside protection.

By using options trading concepts and capitalizing on leverage, a strangle strategy can help traders maximize returns while managing risk effectively.

Benefits of Options Trading

Options trading has benefits over other forms of trading. Here are some advantages:

- Traders can control more shares with less money using leverage. This can increase returns on investment.

- Options trading limits potential losses to the premium paid for the option, providing downside protection.

- By using call and put options strategically, investors can manage risk and diversify their portfolios effectively.

- Options trading offers flexibility in strategies to capitalize on market movements, earnings reports, or dividend stocks.

- Generating income is possible through covered calls or protective puts.

- Understanding and using options trading appropriately can result in higher returns, lower risk, and better portfolio management.

Risks Associated with Options Trading

Traders who do options trading should know about the risks involved. One risk is that options can become worthless if the stock price doesn't move as expected, leading to losing the premium paid. Also, using leverage in options trading can increase risks because a small price change in the asset can cause big losses. To handle these risks, traders can use strategies like covered calls or protective puts to reduce downside risk.

It's important for investors to grasp the connection between the strike price and the market price of the asset, as well as the moneyness of the option. By spreading investments across different assets, traders can lower risk and improve chances of making a profit. Understanding the risks in options trading and using proper risk management strategies can help traders navigate the market's complexities and protect their money.

Using Leverage in Options Trading

Definition of Leverage

Options trading leverage allows traders to control a larger position with less capital. For instance, buying a call option on a stock with a $50 strike price for a $5 premium gives the right to buy 100 shares at $50 each for $500 (excluding the premium).

This leverage can amplify returns but also increase risks. Traders magnify market movement impact on investments through leverage. However, losses can also be larger if trades go the wrong way. Understanding leverage and its effects is crucial for forming effective options trading strategies.

How Leverage Works in Options Trading

Options trading uses leverage to increase gains and losses. Traders can control a big position with less money.

For example, a trader can buy an option for 100 shares at a lower cost than the stock's price.

If the stock moves favorably, the return can be high. But, losses can be big too.

Managing the risks of leverage is important for an options trading portfolio.

Using strategies like covered calls or protective puts can help enhance trading.

Traders must find a balance between boosting returns and limiting risks to meet their investment goals.

Analysis Tools for Options Trading

Technical Analysis

Technical analysis is important in options trading. It helps traders identify trends and entry/exit points.

Traders use indicators like moving averages, RSI, and MACD to make informed decisions based on past price movements.

Chart patterns such as head and shoulders, double tops and bottoms, and triangles are also used to predict future price movements.

Analyzing these patterns helps traders create strategies to benefit from the security's price movements. For instance, a trader might use a long put option in a bearish market or a covered call to generate income from existing stocks.

Using technical analysis offers insights into market trends, helping traders manage risk and potentially earn returns.

Fundamental Analysis

Options trading involves two types of analysis:

- --Fundamental analysis:--

- Assesses the intrinsic value of assets like stocks to predict price changes.

- Considers factors like the company's financial health, market trends, dividends, and earnings potential.

- Explores management quality, industry trends, and competitive standing for insights.

- --Technical analysis:--

- Focuses on historical price patterns and volumes to forecast future prices.

- To form effective options strategies, understanding the stock's price relation to its security, expiration date, strike price, and premium paid is crucial.

- Traders can maximize returns and manage risks with strategies like covered calls, protective puts, or straddles.

Creating a Trading Plan for Options Trading

Setting Goals

When setting goals for options trading, traders should consider factors such as:

- The price of the underlying asset,

- The strike price of the options,

- The expiration date of the contract,

- The risk associated with the trade, and

- The potential return on investment.

Setting specific and measurable goals is important. It can help traders focus on strategies to:

- Manage risk,

- Maximize profits, and

- Protect their capital.

For example, by setting a goal to generate income through selling covered calls on dividend stocks, investors can beat inflation and earn passive income.

Setting a goal to buy protective puts can offer downside protection in a volatile market while limiting potential losses.

By defining clear objectives and aligning them with a trading strategy, traders can increase their chances of success in options trading. This can be achieved by leveraging the power of capital and moneyness.

Identifying Entry and Exit Points

When trading options, identifying entry points effectively involves considering several factors:

- Market price of the underlying asset

- Strike price

- Expiration date

- Moneyness of the option

By analyzing these variables, a trader can strategically enter into a call option for a bullish market or initiate a put option for downside protection.

Additionally, analyzing the premium paid for the option, along with the intrinsic value and extrinsic value, can guide the trader in making informed decisions.

Determining the best exit points in options trading involves assessing:

- Return on investment

- Potential risks

- Market conditions

Factors such as the stock's movement, earnings reports, and dividend payouts can influence when an investor should close out their position.

Properly managing the risk associated with options trading is crucial. It determines the capital invested and the leverage used in the trade, impacting the overall profitability of the investment portfolio.

Choosing the Underlying Asset for Options Trading

Understanding the Underlying Asset

When starting options trading, traders should analyze the asset behind the options carefully. Factors like stock price, shares, dividends, and asset security are important. Understanding the strike price, expiration date, and market price relationship is crucial for smart decisions. Picking the right asset impacts risk and potential return. Knowing moneyness, intrinsic value, and trends is important. The choice can offer protection, leverage capital, and beat inflation.

Understanding the asset is key for successful options trading and building a strong portfolio.

Selecting the Right Option Contract

When choosing an option contract, it's important to think about the strike price and expiration date that match your trading plan. Consider factors like the security's price, market conditions, and the level of risk you're comfortable with.

You can pick a call option, put option, or other types based on your market view and goals. Strategies such as covered calls, protective puts, straddles, and long positions can help reduce risk and boost returns.

Understanding the intrinsic value of the contract is key. It helps in deciding whether to invest in dividend stocks, hedge against inflation, or take advantage of earnings season.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Evaluate the moneyness, market price, and existing positions to manage capital effectively and shield against losses.

By grasping option trading intricacies and applying suitable strategies, you can develop a balanced investment plan with limited risk and higher potential for profits.

Conclusion

Options trading is about buying and selling contracts. These contracts give the holder the right (but not the obligation) to buy or sell an asset at a set price before a certain date.

Leverage is a big part of options trading. It lets investors control a bigger position using less capital.

But, leverage can boost both gains and losses. This is why beginners should know the risks before diving into the options market.

FAQ

What is options trading?

Options trading is a form of investing where investors buy or sell contracts that give the right, but not obligation, to buy or sell an asset at a specific price before a certain date. For example, buying a call option on a stock allows you to purchase shares at a set price.

How does leverage work in options trading?

Leverage in options trading allows investors to control a large position with a small investment. For example, buying a call option for $1 allows the control of 100 shares. This magnifies potential gains or losses.

What are the risks associated with using leverage in options trading?

The risks associated with using leverage in options trading include magnified losses, margin calls, and increased volatility. For example, a small change in the underlying asset's price can lead to significant losses when using leverage.

Are there any benefits to using leverage in options trading?

Yes, using leverage in options trading can amplify gains but also increase risk. For example, using leverage can allow you to control a larger position with less capital, potentially leading to higher returns. However, it is important to use leverage cautiously and manage risk effectively.

What are some common strategies for beginners in options trading?

Some common strategies for beginners in options trading include buying call or put options, using covered calls, and implementing spreads like vertical or calendar spreads. These strategies allow beginners to limit risk and maximize potential returns.