Intro

Are you a small business owner? Do you want to improve your cash flow? Accounts receivable financing might be the solution you need.

By using your unpaid invoices, you can access a consistent flow of funds to help your business grow. Let's see how this financing option works and how it can benefit your business.

Let's explore how accounts receivable financing can boost your business to new heights!

Definition of Accounts Receivable Financing

Accounts receivable financing is a type of business financing that involves using invoices as collateral to secure a loan.

This differs from traditional bank financing as it allows companies to access funds quickly by essentially selling their accounts receivable to a financier.

By leveraging their accounts receivable, businesses can unlock cash flow and improve their working capital position without taking on additional debt. Businesses can even turn to an asset management group that specializes in helping businesses optimize this process for maximum financial efficiency.

However, this financing arrangement comes with risks, such as potential fees from the factoring companies and the risk of customer non-payment.

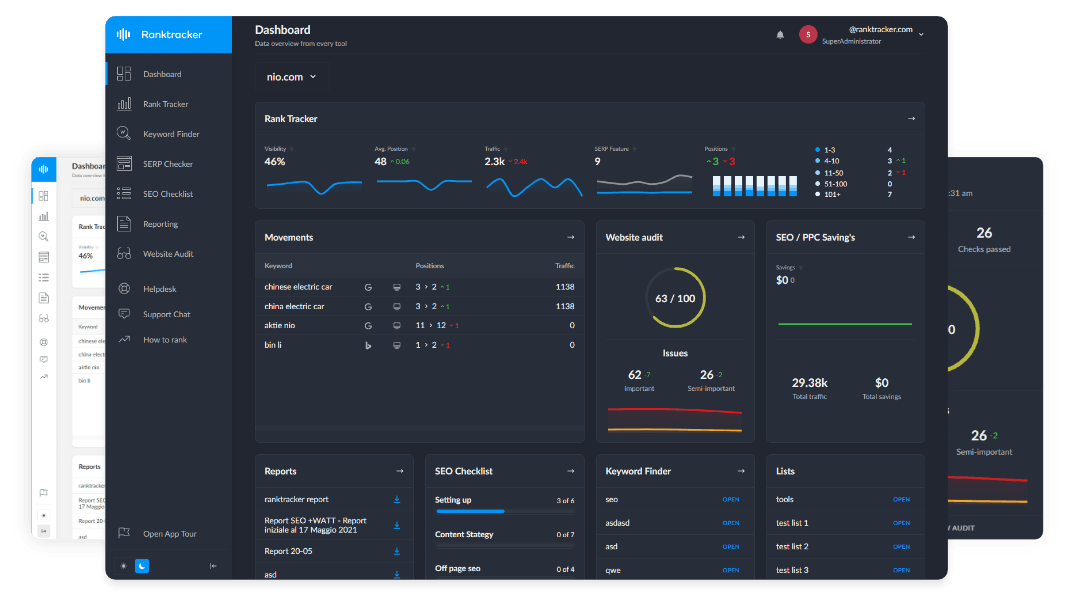

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

While accounts receivable financing can be a quick solution for cash flow needs, businesses should also consider alternative financing options like lines of credit or asset-based loans, which may be cheaper in the long run.

Understanding the Basics

Accounts Receivable Factoring vs. Traditional Bank Financing

Accounts receivable factoring and traditional bank financing are different in how they provide business funding.

Traditional bank loans need collateral and good credit scores. Accounts receivable financing uses unpaid invoices to secure capital.

Factoring companies buy these invoices at a discount, giving immediate cash flow without creating debt.

This benefits businesses with inconsistent cash flow or weaker credit history.

Bank financing is stricter, focusing on creditworthiness and financial health.

Businesses with short-term cash flow issues often prefer accounts receivable factoring for quicker access to funds.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Selling invoices can improve quick ratio, provide working capital, and avoid new debt risks.

Efficient management of accounts receivable helps maintain cash flow and financial stability for businesses.

Key Takeaways on Structuring Accounts Receivable Financing

Businesses should consider several factors when structuring accounts receivable financing to maximize its benefits.

They can use their invoices as collateral to secure a loan or line of credit based on the invoice value. This provides quick access to capital without affecting the balance sheet.

This financing method makes managing cash flow and working capital more efficient because it converts accounts receivable into immediate cash.

However, companies should be wary of potential drawbacks like high fees charged by financiers, which can reduce profitability.

Risk management is also essential to ensure customers fulfill payment obligations as agreed.

Understanding accounts receivable financing can help businesses improve liquidity and financial health. Lastly, using proposal software can streamline the process of presenting financing options to potential lenders, making it easier to secure favorable terms.

Advantages of Accounts Receivable Financing

Unlocking Cash Flow

Businesses can improve their cash flow through accounts receivable financing. This involves using outstanding invoices to get a loan.

By doing this, companies get immediate capital from unpaid invoices. It helps with cash flow needs.

This strategy boosts working capital. It helps meet financial obligations and invest in growth.

Managing accounts payable is also important. It keeps cash flows balanced.

Businesses can work with financiers to set up an accounts receivable financing or using a Financial Planner. They use their invoices as collateral.

This arrangement lowers risk for lenders. It also gives businesses funds to keep running and expand.

Accounts receivable financing is a helpful solution for businesses to optimize cash flow and asset value.

Leveraging Current Assets

Businesses can boost working capital by leveraging current assets, such as accounts receivable, through financing options like factoring. This involves selling outstanding invoices to a financier to quickly obtain money instead of waiting for customer payments. It's a way to increase working capital without taking a traditional loan.

Effective management of accounts payable is crucial in this process to maintain a healthy cash flow. By carefully balancing the payment terms of accounts payable with the collection of accounts receivable, a company can maximize the value of its assets. While accounts receivable financing can help boost business cash flow by leveraging unpaid invoices, it's essential to consider other financial strategies. For individuals evaluating personal credit options, understanding card eligibility scores can be crucial in determining the likelihood of being approved for various credit cards. This financing arrangement offers a solution for short-term cash needs without increasing debt on the balance sheet.

Utilizing current assets like accounts receivable financing can help businesses enhance liquidity and manage risks effectively.

Managing Accounts Payable

Businesses often focus on managing their accounts payable to improve cash flow. By handling incoming invoices strategically, a company can have enough working capital for expenses. This eliminates the need for costly loans. Tactics like negotiating longer payment terms with suppliers, using online platforms for invoice processing, and setting clear payment policies can all help reduce payment delays and enhance cash flow.

Moreover, utilizing options like accounts receivable financing can offer a quick capital boost based on outstanding invoices' value. This is beneficial during high expense or low revenue periods. Managing accounts payable actively allows a business to track debts, lower financial risk, and maintain a healthy balance sheet. Through effective accounts payable management, businesses can achieve financial stability to succeed in today's competitive market.

Boosting Working Capital

Accounts receivable financing helps businesses increase their working capital. This tool involves getting a loan based on outstanding invoices for quick access to money. Businesses sell their invoices to a financier at a discount for immediate cash, addressing short-term cash flow needs. This process turns accounts receivable into liquid assets, boosting working capital and sustaining operations.

Additionally, using this financing can help manage accounts payable, lowering debt risk and keeping a healthy balance sheet. It enhances cash flow, quick ratio, and provides flexibility in financial management. The main benefits include quicker access to funds, improved cash flow, and better financial obligation management.

How Accounts Receivable Financing Works

Underwriting Process

The underwriting process for accounts receivable financing involves several steps:

First, the financier assesses the value of the business's outstanding invoices to determine the capital amount. This assessment is based on the creditworthiness of customers, whose payments serve as collateral for the loan.

Accounts receivable financing focuses on invoice value over a company's financial history. Factors like quick ratio, liquid assets, and customer credit score are considered.

By evaluating these factors, financiers can assess risk associated with funding accounts receivable. The goal is to ensure assets cover the loan payment.

The process aims to provide a short-term solution for businesses to improve cash flow through the sale of their accounts receivable. This lets companies use assets without adding debt.

This financing strategy is valuable for managing accounts payable and collections. It includes fees, balances, and managing the client's balance sheet.

AR Finance Example

An AR Finance Example showcases the advantages of accounts receivable financing for businesses.

Companies can improve their working capital and invest in growth opportunities by converting outstanding invoices into immediate cash through a loan.

When structuring an accounts receivable financing agreement, factors such as the invoice value, creditworthiness of customers, and the company's balance sheet need to be carefully evaluated to mitigate risk.

In practice, accounts receivable financing involves a business selling its invoices to a financier at a discount in exchange for quick access to money.

This strategy can help manage cash flow, reduce debt, and enhance the company's overall financial management.

Businesses can leverage their accounts receivable as a valuable asset sale to secure a line of credit and boost their capital without taking on additional debt or collateral by using this short-term solution.

Disadvantages and Distractions of Accounts Receivable Financing

Potential Risks and Challenges

Potential risks associated with accounts receivable financing include the potential for customers to default on payment, leading to cash flow issues for the business relying on the financing.

Additionally, if the invoices used as collateral have inaccuracies, the financier may reject them, impacting the company's ability to secure the necessary funds. This financing arrangement also comes with fees and interest charges that can add up over time, increasing the overall cost of borrowing. Challenges from utilizing accounts receivable financing as a funding option may involve managing the balance between leveraging invoices for immediate capital needs and ensuring a healthy level of working capital for daily operations. Businesses must also consider how factoring companies may interact with their customers during collections, as this can impact client relationships.

Furthermore, the risk of debt accumulation and the impact on a company's balance sheet and credit score should be carefully managed when engaging in accounts receivable financing.

Long-Term Costs and Considerations

When thinking about accounts receivable financing, businesses should know about the potential long-term costs.

By using financing with invoices, companies might face higher fees from factoring companies or financiers. This can impact their bottom line.

There is also a risk of customers not paying. This could lead to accumulating debt.

Businesses should carefully see how accounts receivable financing affects their long-term financial health and stability.

They should consider how it impacts their balance sheet, credit score, and debt levels.

Businesses should also look at how using accounts receivable financing affects their working capital and ability to invest in growth opportunities.

By considering these factors, companies can create a good financing strategy. This will reduce risk and increase the value of their assets in the long term.

Cheaper Alternatives to Accounts Receivable Financing

Exploring Other Financing Options

Businesses have different financing options to explore besides accounts receivable financing. They can consider traditional bank loans, lines of credit, and asset-based lending.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

For instance, factoring involves selling invoices to a financier for immediate cash at a discount. Asset-based lending uses a company's collateral like inventory or equipment to secure a loan.

These financing options vary in cost, flexibility, and availability. Companies need to balance fees, rates, immediate capital needs, and long-term financial goals when choosing.

Understanding how these choices affect a company's balance sheet, cash flow, and risk management is important. Evaluating factors like credit score requirements, debt levels, and collection management helps businesses make informed decisions to support growth and financial stability.

Final thoughts

Accounts receivable financing helps businesses access cash by selling unpaid invoices at a discount to a third-party lender.

This option is quick and efficient, allowing companies to improve liquidity without incurring more debt. It's a great way to address short-term cash flow needs.

FAQ

What is accounts receivable financing?

Accounts receivable financing is a type of funding where a company receives a loan based on its outstanding invoices. The lender collects payments directly from the customers. This can help improve cash flow and provide working capital for business operations.

How does accounts receivable financing help unlock cash flow?

Accounts receivable financing helps unlock cash flow by providing immediate funds for outstanding invoices. This can help businesses with limited capital to cover expenses, invest in growth opportunities, and ensure smooth operations.

What are the benefits of using accounts receivable financing?

Accounts receivable financing provides immediate cash flow, improves working capital, and helps businesses meet expenses like payroll, inventory, and growth opportunities. This financing option can also reduce the risk of bad debt and improve credit ratings for businesses.

Is accounts receivable financing a common practice in businesses?

Yes, accounts receivable financing is a common practice in businesses, especially for small and growing companies. It allows businesses to access cash quickly by using their outstanding invoices as collateral. Many industries, such as manufacturing, staffing, and transportation, utilize accounts receivable financing to improve cash flow.

How can businesses qualify for accounts receivable financing?

Businesses can qualify for accounts receivable financing by having a steady stream of outstanding invoices from creditworthy customers. They should also have a track record of timely payments and strong financial stability. Examples of qualifying industries include manufacturing, distribution, and professional services.