Intro

Something interesting is happening in real estate search trends lately. People aren’t just looking up “homes for sale” anymore. More and more, they’re typing in things like “first-time homebuyer loans in Dallas” or “low down payment options in Florida.”

It’s a small shift in keywords — but it tells a big story.

Let’s talk about why this is happening, what it means for the real estate world, and how professionals can get ahead.

First Off, Let’s Understand Keyword Trends in Real Estate

The way people search online says a lot about what they need. In real estate, that usually means phrases like “houses for sale near me” or “best neighborhoods in [city].” These are the kind of searches agents and websites have focused on for years because they show what buyers are interested in.

But things are changing.

Lately, more folks are typing in things like “how much do I need to buy a house in [city]” or “local home loan programs.” These aren’t just about finding a house — they’re about figuring out how to afford one.

That shift in search terms, also known as keyword trends, shows us that buyers today are thinking more about money than ever. Instead of just dreaming about their perfect home, they’re trying to understand what’s actually possible for their budget — especially with rising prices and tighter lending rules.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Eli Pasternak, Founder & CEO of Liberty House Buying Group, shares, “When we talk about keyword trends in real estate, we’re really just talking about what questions people are asking Google when they’re trying to buy a home. And right now, a lot of those questions are about money.”

What’s Causing the Shift Toward Local Finance Keywords in Real Estate?

Here’s why these local finance searches are on the rise.

The Cost of Homeownership is Rising

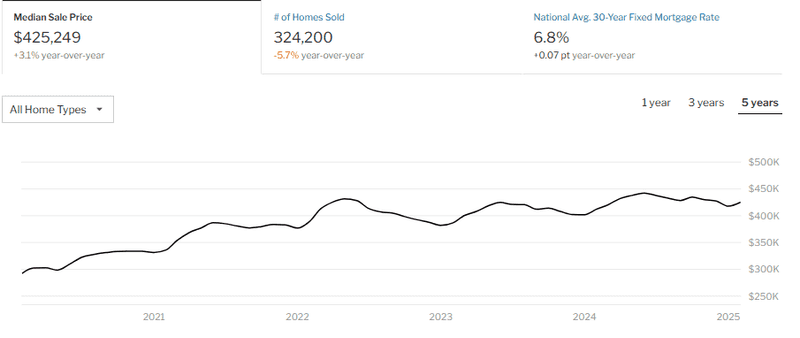

First, the obvious. Homes are more expensive now than they were a few years ago — and interest rates aren’t helping. Right now, the median home price in the U.S. sits around $425,249.

Image Source: Redfin

What used to feel within reach now feels like a stretch for many buyers, especially first-timers. That’s pushing people to start their home search with one big question — How can I afford this?

Instead of just looking at properties, they’re turning to Google to figure out if there’s any financial support out there. And because affordability varies so much from one place to another, their searches are becoming more local. That’s why queries like “low down payment loans in Phoenix” or “mortgage help for first-time buyers in Ohio” are becoming more common.

Adam Fard, Founder & Head of Design at UX Pilot AI, explains, “Today’s buyers aren’t just searching for homes — they’re searching for solutions. If brands can show up with the right answers at the right time, they’re already halfway to building trust.”

Buyers Are Starting Their Journey with Money Questions

In the past, a home search might have started on Zillow or Redfin with filters like square footage or number of bathrooms. Now, more people are beginning their journey in a completely different way — they want to understand if they can buy before they even look at what to buy.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

That means searches around finances — things like “how much house can I afford in Austin” or “income needed for a mortgage in Chicago” — are happening right at the start. And because every market is different, buyers are adding their city or state into the search to get answers that are actually relevant to them. This change in behavior naturally boosts local finance-related keywords.

More Local and State Programs Are Available

There are simply more local programs out there now than ever before. Cities, counties, and even neighborhoods have started offering assistance to help first-time buyers, low-income families, and essential workers become homeowners. Some offer grants. Others offer favorable loan terms or help with closing costs.

The increase in these programs has led to more people searching for them by name or location. For example, when California launched its Dream for All Shared Appreciation Loan, search interest exploded overnight. Suddenly, everyone wanted to know, “Is there a program like this in my state?”

Stephen Babcock, Founder & CEO of CampAlibi.com, puts, “When people hear about a great program in one place, they immediately wonder if they can get the same help where they live. Good local promotion turns curiosity into real action.”

And even when the programs aren’t brand new, cities are doing a better job promoting them — through local campaigns, social media, and email newsletters. That visibility is driving more specific search behavior.

Gen Z and Millennials Are Research-Driven

Today’s buyers aren’t walking into an agent’s office and asking, “What can I afford?” They’re researching everything themselves first — credit score requirements, loan types, interest rates, and government programs. They want to come in prepared.

That’s especially true for Gen Z and younger millennials who’ve grown up Googling everything. They’re far more likely to type in very specific searches like “FHA loan options in New York” or “homebuyer grants under 30 in Colorado.” They trust search results, comparison tools, and real stories shared on Reddit or YouTube. This is why it’s more important than ever for a real estate agent to be visible where these buyers are searching—and to provide quick, personalized responses. Many top-performing agents now rely on a virtual real estate assistant to help manage online inquiries, organize financial resources, and maintain a strong digital presence that matches the research-driven habits of younger buyers

And because they know buying a home involves more than just finding the right one, they dig into the financial side early — and they dig deep.

Mark Mechelse, VP of Marketing at Master Magnetics, mentions, “Younger buyers aren’t just looking for homes — they’re looking for answers. Brands that make financial information easy to find and understand will be the ones who win their trust.”

Financial Uncertainty Has Changed Buyer Behavior

People are just more cautious now. With inflation, student loans, rising rent, and job market uncertainty, buyers are thinking long and hard before jumping into homeownership. And when money feels tight, the idea of leaning on local programs or exploring special financial options feels safer and smarter.

Local finance-related searches reflect that mindset. Buyers want to know what’s available in their city, who they can trust in their area, and how to stretch their budget without taking big risks. “Searching locally feels more personal, more targeted, and more manageable in uncertain times,” adds Eric Andrews, Owner of Mold Inspection & Testing.

Factors Driving This Shift

Here are the main reasons behind this change in search behavior.

Affordability Crisis

We’ve already talked about how expensive homes are now. Prices have gone up a lot over the past few years, and interest rates have followed. That means even if someone is looking at a fairly average-priced home, the monthly payments can feel way out of reach. And for first-time buyers, who might not have a big down payment saved up, it feels even harder.

So what do people do? They turn to Google.

They’re not just searching for “3-bedroom homes near me” anymore. Now they’re adding things like “affordable” or “down payment help” or “low-income home loans.” People are hoping there’s a program or local resource out there that can make homeownership more doable — and in many places, there actually is.

For example, Bank of America’s Community Affordable Loan Solution gained a lot of attention for offering no down payment and no closing cost loans in select minority neighborhoods.

Image Source: CNBC

It sparked massive interest online and sent thousands searching for similar programs in their own cities.

Millennial and Gen Z Buyers

And the next major reason for the shift is — a new wave of buyers.

Millennials are now well into their 30s, and Gen Z is just entering the market. For a lot of them, this is their first time seriously thinking about buying a home. And they’re not doing it the way their parents did. They’re more likely to research online, compare options, read reviews, and look up financial programs before ever calling an agent or a lender.

They want to understand everything. How loans work. What the interest rates mean. Whether they qualify for any help. And most importantly, what they can actually afford in their local area.

That means a lot more specific searches, like.

- “First-time home buyer loan California”

- “Down payment assistance Atlanta”

- “How to buy a house with no money down Texas”

Local Incentives & Grant Awareness

There are more local programs out there than people realize.

Cities, counties, and even small towns are offering grants, tax breaks, and loan support to help people buy homes — especially first-time buyers or people moving into underdeveloped neighborhoods. These programs have been around for a while, but in the past few years, they’ve become easier to find, easier to qualify for, and better promoted online.

Steve Caya, Wisconsin Personal Injury Lawyer at Nowlan Personal Injury Law, notes, “Access to clear, local support programs can be a game-changer for people trying to buy their first home. When information is easy to find and understand, more buyers feel confident enough to take the next step.”

So naturally, search traffic around these programs is going up.

Someone might hear about a friend getting a $10,000 grant to buy a home and immediately go search for “first-time buyer program in [my city].” Or a social media ad might pop up talking about local loan assistance—and people go looking for details.

The more visible these programs become, the more people search for them. It’s a simple loop: local incentives lead to more interest, which leads to more local finance-related searches.

For agents and lenders, this is a golden opportunity. If you talk about these programs and explain them clearly, you can become a go-to resource for people looking to buy—but unsure where to start.

Increased Online Financial Literacy

We’re living in a time where people are doing a lot more self-education—especially when it comes to money. There are thousands of blogs, YouTube channels, TikToks, and podcasts dedicated to explaining everything from budgeting to credit scores to how mortgages work. And people are paying attention.

As a result, buyers are asking better questions. They know a high interest rate affects their long-term costs. They’ve heard about FHA loans and want to know if they qualify. They’re aware of things like closing costs and want to plan for them.

So instead of typing “houses under $300k,” they’re typing “mortgage calculator with taxes and insurance,” or “best low-interest home loans in [state].” That kind of search shows up in keyword data—and it’s been rising.

This shift means real estate professionals should think differently, too. Bryan Dornan, Mortgage Lending Expert & Founder at Quick HELOC Funding, shares, “Buyers aren’t just looking for a home — they’re trying to understand the full picture. If your content or advice covers financial questions, not just property listings, you’ll attract a more prepared and serious audience.”

How to Optimize for Local Finance Keywords

Here’s how to optimize for local finance keywords.

Use Location-Based Phrases in Your Content

The first step is to make sure your content actually mentions the places you serve. For example, if you're working in Phoenix, make sure you're not writing about “homebuyers in the U.S.” but about “homebuyers in Phoenix.” Google pays attention to that kind of wording. It helps your content get found when someone searches for a term that includes the name of their city or town.

So instead of just saying, “There are lots of great loan options for first-time buyers,” you could say, “If you’re buying your first home in Phoenix, here are a few loan options that might work for you.”

Siebren Kamphorst, COO of Rently, advises, “Just calling out the location makes your content more specific — and that’s what people (and search engines) are looking for.”

Create Pages or Blog Posts Focused on Local Programs

One of the most effective things you can do is write about specific financial programs available in your area. These might include city grants, statewide assistance, or even smaller community-based incentives.

For example, if your city offers a down payment assistance program, write a blog post or page explaining how it works in plain language. Talk about who it’s for, what kind of help it gives, how someone can apply, and what they need to qualify.

According to Dan Close, Founder and CEO of BuyingHomes.com, “When buyers search for help with financing in your city, they’ll find your content — and hopefully, trust you enough to reach out. The goal isn’t to sound formal or perfect. Just be clear, be real, and offer value.”

Add Keyword Variations Naturally

When writing about local finance topics, you don’t need to repeat the same phrase over and over. In fact, it’s better if you don’t. Instead, use natural variations of the keyword.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

If you’re writing about homebuyer loans in Tampa, you might also mention things like “first-time buyer help in Tampa,” “affordable housing programs in the Tampa Bay area,” or “how to buy your first home in Tampa.”

You don’t need to force it — just write the way you’d explain something to a friend or client. If you stay on topic and keep things local, the right words will show up on their own.

Bill McCormick, President of NRT Specialty Trailers, shares, “The best content feels natural and honest. When you focus on being clear and helpful, you naturally build trust — and that’s what turns readers into real customers.”

Conclusion

People aren’t just looking for homes anymore — they’re looking for ways to pay for them. Prices are high, interest rates are up, and buying a home feels harder than before. That’s why more people are searching for local help, like grants or loan programs in their city or state.

If you work in real estate, this is your chance to help. Share info that makes things easier to understand. Talk about money, not just listings. Because that’s what buyers care about right now — how to make homeownership possible.