Intro

In the rapidly evolving world of FinTech, the landscape is set to become even more dynamic by 2024. Amidst such expansion, a well-crafted, agile marketing strategy becomes indispensable.

It can pave the way for success, ensuring that your brand connects with the burgeoning user base and harnesses the potential of the fintech revolution. Let's delve into crucial tips and tricks for developing a marketing strategy that does just that.

Identifying your target audience

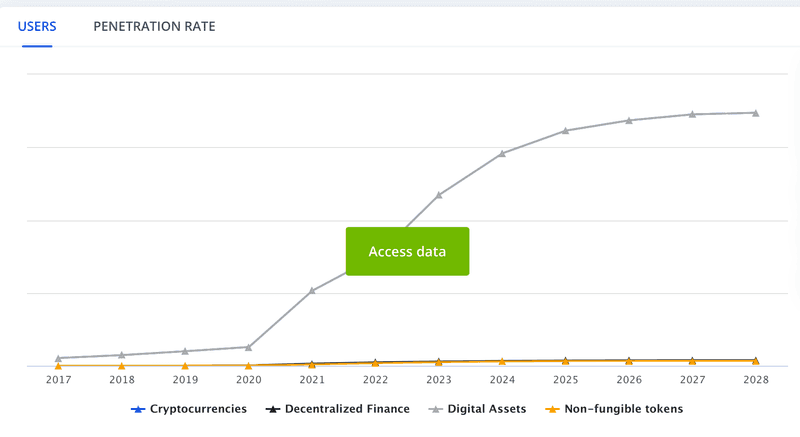

The digital markets are on the brink of unprecedented growth, poised to welcome an estimated 992.50 million users by 2028. Thus, unraveling the right digital marketing strategies for fintech brands begins with identifying your target audience.

Understanding their needs, behaviors, and preferences lays the foundation for impactful marketing. But who exactly is your target audience in the evolving fintech landscape?

In the upcoming sections, we'll dissect this crucial question, leading to effective strategies that capture suitable attention.

Analyzing market demographics

Analyzing market demographics is a cornerstone of effective digital marketing strategies for fintech brands. It involves scrutinizing relevant data to ascertain crucial characteristics of potential customers. Age, income, occupation, and location are fundamental demographic parameters.

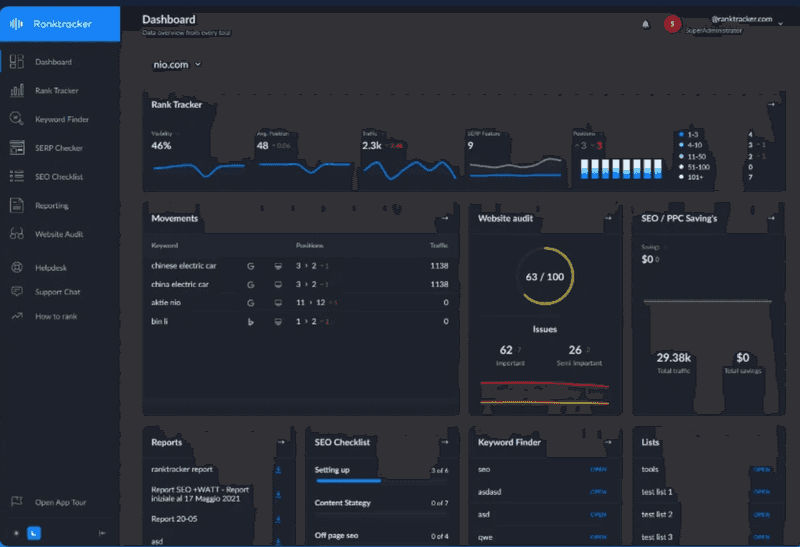

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

However, fintech brands need to dig deeper. They should scrutinize financial behavior, preferences in digital platforms, and attitudes toward financial technology.

With a comprehensive demographic analysis, fintech brands can customize their digital marketing strategies to suit their target audience's needs, habits, and preferences. By doing so, they can enhance engagement, foster customer loyalty, and drive growth in the fiercely competitive digital market.

Understanding the needs of your audience

Understanding the specific needs of your audience is vital in the realm of fintech marketing. This insight opens the door to innovative fintech marketing ideas that align with customer needs.

Predominantly, users seek solutions that simplify their financial affairs, offer robust security, and provide a seamless user experience. Fintech brands must, therefore, aim to deliver accessible, secure, and intuitive platforms.

Additionally, customers appreciate personalized services that make them feel valued and understood. By integrating these pieces into your marketing strategy, you clearly understand your audience's needs, significantly improving your brand's appeal and customer loyalty.

Segmenting your market effectively

Effective market segmentation forms the backbone of successful fintech branding techniques. Splitting your audience into demographic, geographic, or behavioral groups allows for targeted marketing and increased engagement rates.

Fintech brands can dissect their market into easily manageable segments using data analytics. These segments can be as broad as specific age groups or as niche as client risk tolerance levels.

The goal is to shape marketing efforts to resonate with each group's unique needs and preferences. A nuanced understanding of these segments aids in delivering a personalized and meaningful user experience.

Competitor analysis

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

A solid marketing strategy is paramount in the fiercely competitive fintech landscape. Businesses need more than just an understanding of customer needs and market segmentation. It's also crucial to stay one step ahead of your competitors.

This segues us into the realm of competitor analysis, a crucial facet of any marketing strategy. By dissecting your competitor's moves, you can identify opportunities for your brand to shine. Let's dive deeper into this essential aspect of strategic planning.

Identifying your main competitors

Identifying your main competitors in the fintech sector requires meticulous research. Start by looking at other fintech brands that share your target audience. Analyze their digital marketing strategies, focusing on how they position themselves and communicate with their customers.

Delve into their content marketing, social media presence, SEO techniques, and paid advertising. A comparative study of their campaigns can reveal their strengths and weaknesses. This information can provide valuable insights, helping refine your marketing strategy and make it more compelling.

Learning from competitor strategies

By studying competitor strategies, you gain a wealth of knowledge. They often showcase innovative fintech marketing ideas that you can adapt. Observations may reveal successful SEO tactics, compelling social media campaigns, or practical content marketing approaches.

Understand their user engagement strategies and customer retention methods. Not all strategies align with your brand, but you can unearth valuable lessons. Recognize their missteps, as these can help you avoid similar pitfalls.

Carving your unique position in the market

Carving a unique position in the fintech market demands authentic branding techniques. Your brand should jive with your target audience and distinguish you from competitors. Focus on your unique selling proposition to achieve this distinctiveness. Use clear, concise messaging to convey your USP, engaging customers with your brand's unique value.

Stand out by demonstrating your expertise and reliability in the fintech sector. Implement innovative marketing strategies that effectively communicate your brand's vision and values. Review and refine these fintech branding techniques regularly to ensure consistency, relevance, and impact. Each step towards uniqueness strengthens your position in the competitive fintech space.

Developing your brand identity

Establishing a strong fintech brand identity transcends mere aesthetics; it's about embodying your brand's values and mission. It's the blueprint that guides every decision, interaction, and communication.

As you delve into the nuances of fintech branding techniques, you'll find ways to make your brand memorable and impactful.

Crafting a memorable brand message

Crafting a memorable brand message in the fintech landscape is crucial. Your message should echo your brand's core values, mission, and vision. It's not just about verbal or written content. In fact, every interaction with your audience should deliver this message.

Be clear and consistent in your communication. Avoid jargon and opt for language that your audience understands and resonates with. Regularly review and refine your message to maintain its relevance in the rapidly evolving fintech industry. A robust and memorable brand message is a powerful tool for driving engagement, loyalty, and business growth.

Visual identity and branding elements

A visual identity, a critical aspect of fintech branding techniques, comprises logos, color schemes, typography, and imagery. The visual elements should resonate with your brand's values and align with the brand message.

Consistency in visual identity across all platforms is vital to ensure brand recognition and trust. Remember that your visual identity must be adaptable to the changing fintech landscape while maintaining its essence.

Additionally, ensure your branding elements are distinct, setting you apart from competitors. Remember, a well-executed visual identity acts as a silent ambassador of your brand, enhancing your market presence.

Building brand trust and credibility

Building brand trust and credibility in the FinTech industry is crucial for the success of your business. Trust is earned by demonstrating transparency in financial transactions and ensuring data security.

Innovative fintech marketing ideas can help establish this trust. For example, leveraging testimonials and case studies can showcase your success stories and reliability. Regularly publishing informative, accurate, and relevant content can position your brand as a knowledgeable entity in the fintech field.

Furthermore, securing partnerships with renowned institutions can enhance your credibility.

Maintaining a sound social media presence can also create opportunities for direct communication with your audience, fostering trust and loyalty.

Utilizing technology in marketing

Harnessing innovative fintech marketing ideas can revolutionize your brand's presence and credibility—every facet of your strategy counts, from visually compelling branding to fostering trust through transparency.

As we delve deeper, we'll explore how you can leverage technology to drive your marketing efforts, making your brand a formidable player in the FinTech arena.

The role of AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming digital marketing strategies for fintech brands. AI enables personalized user experiences, fostering customer engagement and loyalty. It can analyze consumer behavior and trends, enabling brands to tailor their offerings precisely.

Machine Learning, a subset of AI, improves over time through experience. It can predict customer preferences and behavior with remarkable accuracy. This can significantly optimize advertising efforts, delivering the right message to the right audience at the right time.

This combination of AI and ML can lead to more efficient marketing, higher conversion rates, and enhanced customer satisfaction for fintech brands. Through continued innovation, these technologies can redefine the future of fintech marketing.

Harnessing big data for targeted marketing

Big Data is revolutionizing digital marketing strategies for fintech brands. It offers immense information on customers' buying behaviors and patterns. When analyzed effectively, this data can target marketing efforts with exceptional precision.

Fintech brands can leverage this to tailor their services and products, ensuring they meet the needs of their customers.

Furthermore, Big Data contributes to advanced analytics, fostering data-driven decision-making. It helps to identify potential markets and customer segments and fine-tune marketing approaches.

For fintech brands, harnessing Big Data gives them the insights to launch targeted marketing campaigns, enhancing their reach and efficacy.

The impact of blockchain on fintech marketing

Blockchain, a groundbreaking technology, is influencing innovative fintech marketing strategies. Its secure, decentralized nature ensures unparalleled transparency and trustworthiness, making it valuable for fintech brands.

Blockchain-based marketing tactics like smart contracts can automate transactions and enhance credibility.

Furthermore, marketers can use blockchain technology to verify digital ad deliveries, eliminating ad fraud instances and ensuring efficient ad spend. This results in cost-effective, impactful marketing campaigns.

Blockchain can accelerate customer engagement and loyalty in the fintech sector with its ability to facilitate peer-to-peer transactions.

Innovations in online financial products

Innovative fintech marketing ideas are revolutionizing the landscape of online financial products, particularly home loans.

The advent of online home loan platforms has simplified the traditionally complex, time-consuming process. These platforms leverage algorithms to evaluate loan eligibility swiftly, dramatically reducing processing time.

The All-in-One Platform for Effective SEO

Behind every successful business is a strong SEO campaign. But with countless optimization tools and techniques out there to choose from, it can be hard to know where to start. Well, fear no more, cause I've got just the thing to help. Presenting the Ranktracker all-in-one platform for effective SEO

We have finally opened registration to Ranktracker absolutely free!

Create a free accountOr Sign in using your credentials

Consequently, customers can secure home loans conveniently from the comfort of their homes. User-friendly interfaces and streamlined application processes make the experience seamless and accessible to a broad range of consumers.

Additionally, advanced security measures ensure significant data protection, bolstering trust in these online platforms. This reimagined approach to home loans presents vast potential for customer acquisition and brand growth in the fintech sphere.

Charting the path to triumph

Navigating the fintech landscape demands innovative strategies and a keen understanding of customers' needs. Embracing technology like blockchain and redefining products like home loans are potent examples of innovation at the heart of fintech marketing. These initiatives streamline processes and build trust, an essential ingredient for success in financial services.

The future of fintech marketing hinges on innovation and customer-centric strategies. By leveraging technology and offering simplified, accessible services, brands can foster enduring relationships with customers, driving growth and solidifying their position in the market.

The journey might be challenging, but with the right approach, the rewards are substantial. As we look to the horizon, the future of fintech marketing sparkles with exciting possibilities. Don't just be a spectator; be a part of this transformation.